- Arp Digital

- Posts

- ARP’s Crypto Digest

ARP’s Crypto Digest

ARP’s Crypto Digest

General Digital Asset Market View:

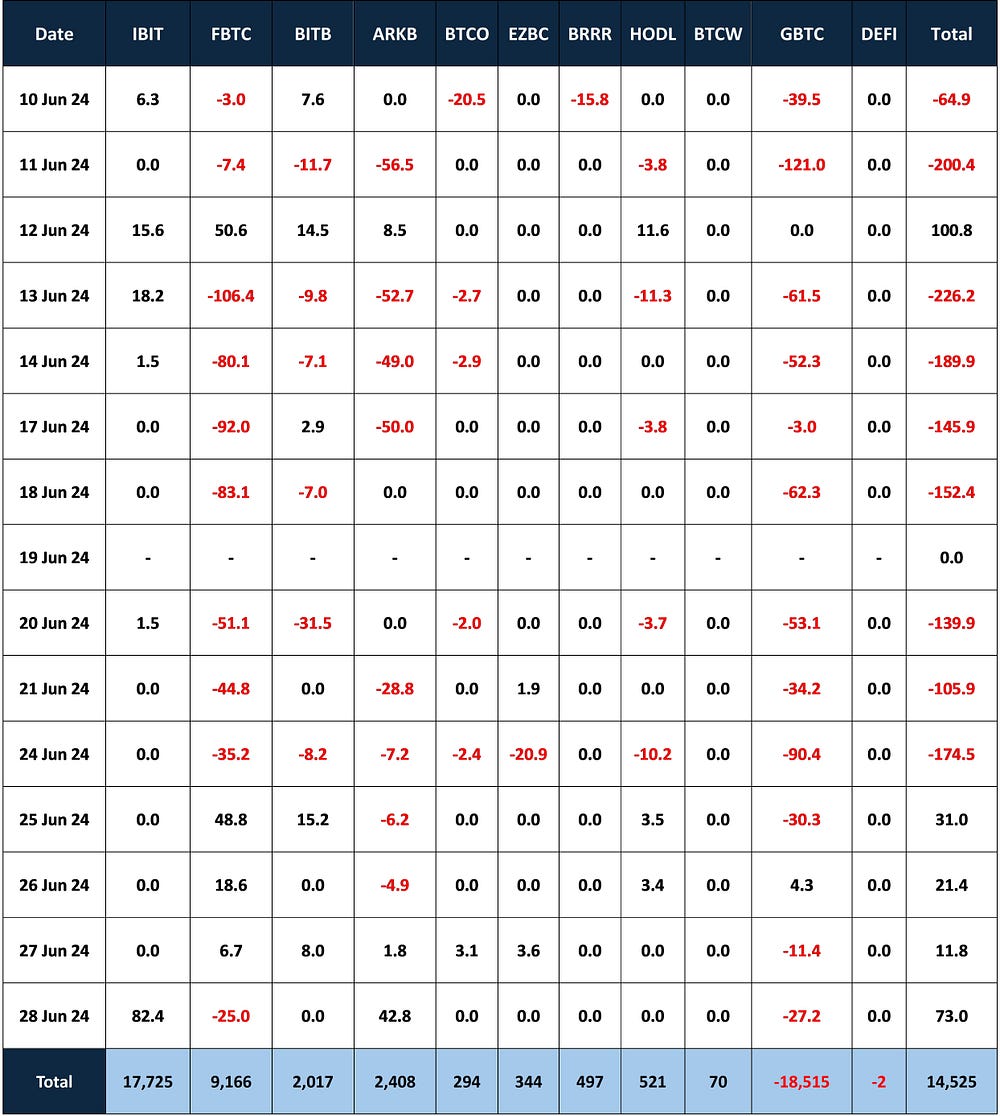

Source: ARP Digital Research Team Q2’24

Grayscale’s $GBTC faced ongoing walks in the red area, with a cumulative outflow of -$90.4M at the beginning of the week, marking a consistent trend of negative net flows. Conversely, BlackRock’s $IBIT, which remained dormant for much of the week, made a significant turnaround with an $83M inflow on the 28th, highlighting its influential position in the market. Fidelity’s $FBTC experienced a mixed week, initially contributing a positive $48M inflow that helped counter early losses, though it ended with some outflows.

While other ETFs like Ark’s $ARKB and Bitwise’s $BITB saw smaller but notable movements, the week ultimately closed on a strong note with a net inflow of $74M especially after the recent red flow weeks.

More Crypto:

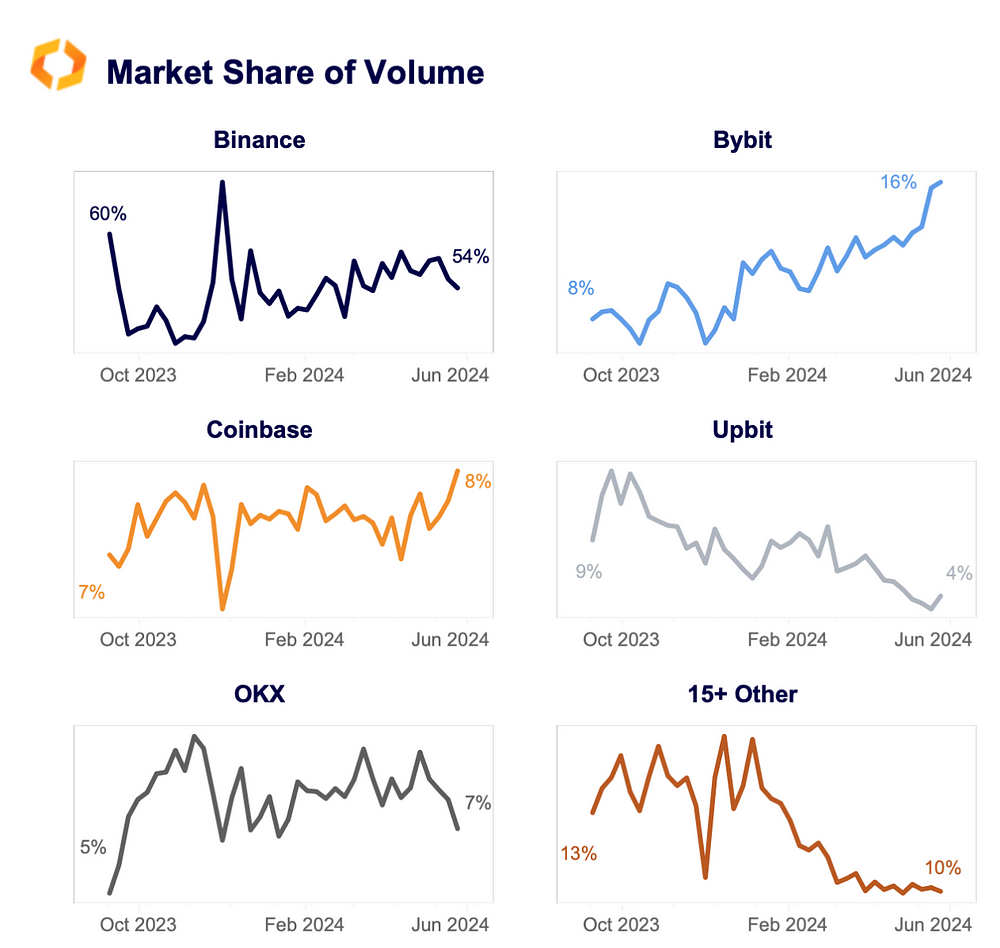

Source: Kaiko Research

Since October, Bybit’s market share has soared from 8% to 16%, overtaking Coinbase in March to become the second-largest exchange, trailing only Binance.

Despite reporting higher revenue and profits, Coinbase’s global market share has experienced only a modest 1% increase during the same period.

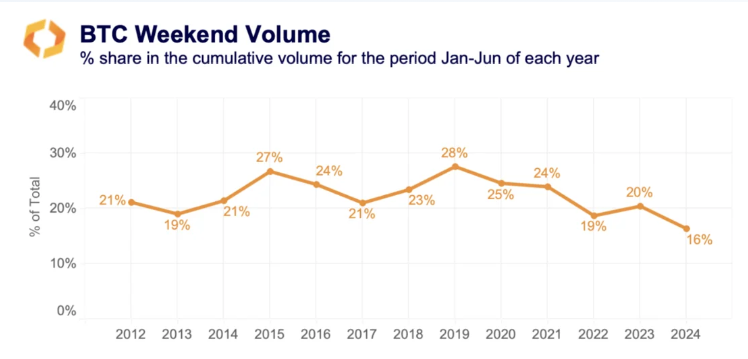

Source: Kaiko Research

The share of BTC trade volumes during weekends has consistently declined since 2021. This downward trend has been exacerbated since the introduction of spot ETFs. Currently, the BTC weekend trading volume stands at an all-time low of 16% in 2024, marking a 12 percentage point decrease from its peak of 28% in 2019. The advent of spot BTC ETFs has contributed to the accelerated widening of the gap between weekday and weekend trading volumes.

What Happened This Week:

Jupiter has launched Jupiter Swap V3. The supply reduction, jupiaries and ASR extensions proposals, vote will be in July.

Pantera Capital continues to actively promote Toncoin.

Jump Crypto President steps down after six years at Jump Trading.

US and Germany governments are selling $BTC. This creating fear of potential sell pressure in the market.

AEVO has updated its tokenomics, committing to at least 1M AEVO buybacks monthly from July to December.

What to Look Out For:

Mt. Gox will start distributing $BTC and $BCH repayments in early July 2024. Approximately 65,000 BTC/BCH will go to individual creditors, less than often reported.

Sui Co-Founder has teased an upcoming announcement for Sui.

Etherfi Foundation has announced a proposal to allocate 25M ETHFI tokens for Season 3.

Friendtech has opened the $FRIEND transferability in preparation for the Friendchain launch.

Arbitrum DAO is proposing to launch $ARB staking. Expected APY is 7% and Voting will occur in next month’s snapshot.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.