- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Spot Bitcoin ETFs saw $536 million in net outflows on Thursday, marking their largest daily withdrawal since August 1. Outflows hit eight of the twelve funds, led by ARKB (-$275M) and Fidelity’s FBTC (-$132M), as investors moved to the sidelines amid growing macroeconomic and geopolitical uncertainty.

The redemptions mirror a broader wave of risk aversion following one of crypto’s biggest liquidation events this year, with over $20 billion in leveraged positions wiped out after Trump’s announcement of 100% tariffs on Chinese imports.

Adding to the pressure, bank contagion concerns have resurfaced, prompting further caution across markets.

Meanwhile, Ethereum ETFs also recorded $56.9 million in outflows the same day, snapping a brief two-day inflow streak.

Macro:

The focus next week will be on the US September CPI report amidst the ongoing government shutdown. Other highlights include the global flash PMIs, economic activity in China as well as inflation in the UK and Japan. Notable political events include China’s Fourth Plenum and the election of a new PM in Japan (Oct 21).

More Crypto:

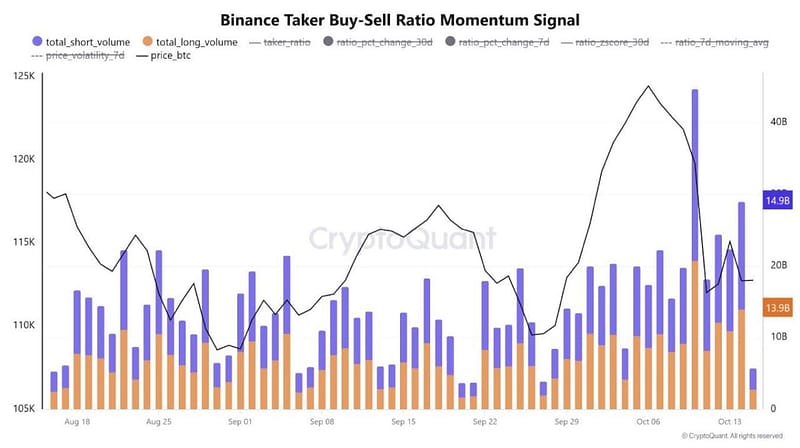

Source: CryptoQuant

Takers, those who fill existing orders, set the tone for price action.

Their sentiment and execution style influence short-term moves and reveal shifts in long-term trader behavior.

Source: Cryptorank

Airdropping 310M tokens in late 2024, Hyperliquid proved that DEXs can match CEXs in speed, UX, and liquidity.

Since then, new players like Aster and Avantis have fueled the momentum, pushing DEX volumes to new highs.

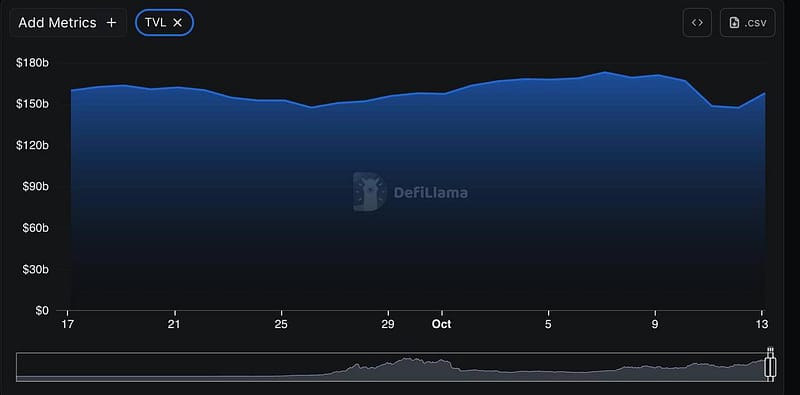

Source: Defillama

DeFi’s total TVL dropped by ~13.5% during the weekend crash, but the rebound was swift.

In just 24 hours, it has already bounced back by nearly 8%, signaling early signs of recovery.

What Happened This Week:

SharpLink Gaming raised $76.5M to buy $ETH and boost its treasury value.

Bitmine bought $418,000,000 in $ETH.

U.S. seeks forfeiture of 127,271 BTC ($12B) linked to a global pig-butchering scam run by Chinese national Chen Zhi.

Stripe adds stablecoin support for recurring subscription payments on Polygon and Base.

What to Look Out For:

Eric Trump confirms plans to tokenize real estate through World Liberty Financial, signaling crypto adoption in property.

VP JD Vance says Trump is open to reasonable tariff negotiations with China.

Trump reportedly considering pardon for former Binance CEO CZ.

Morgan Stanley to allow all clients to invest in crypto, including through retirement accounts.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.