- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Bitcoin ETFs saw $363M in redemptions in late September, led by Fidelity’s $276.7M outflow. While this weighed on price, pushing Bitcoin to a four-week low near $108,700, such swings in ETF flows are not unusual and often reflect tactical rebalancing. With the Fed signaling further rate cuts by year-end after its September move, macro easing could offset near-term caution and support renewed demand for Bitcoin.

Macro:

The risk of a US government shutdown will remain in focus ahead of next week’s September 30 funding deadline. In economic indicators, key events include respective jobs reports and ISM prints in the US, flash CPIs in Europe, Japan’s Q3 Tankan Survey and ROW PMIs. From a monetary policy standpoint, we have a slew of G-7 central bank speakers while the RBA and RBI are also due to meet (no change expected from either). Earnings season is almost complete with the main reporters this week being Jeffries and Nike.

More Crypto:

Source: CryptoQuant

Binance remains the go-to platform for new altcoin listings , concentrating most of the available liquidity.

For traders exploring price discovery and early-stage tokens, Binance is still the first stop.

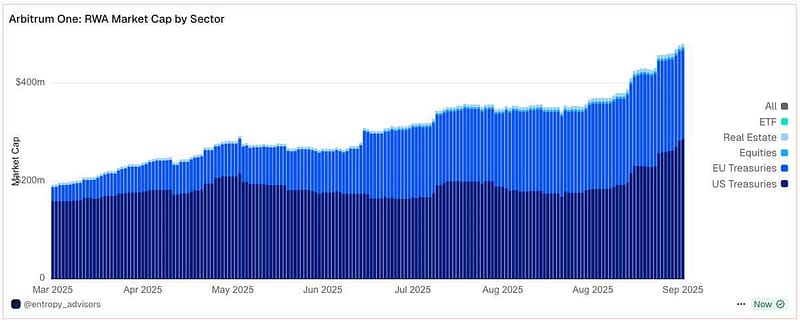

Source: entropy_advisors

RWA assets under management have climbed to $480M, rising $120M (+33%) month-to-date.

The bulk of this growth comes from Theo’s thBILL, which added $65M on its own.

What Happened This Week:

PayPal partners with Spark to boost PYUSD liquidity by $1B via DeFi lending.

Naver to acquire Upbit and integrate it into a trading, payments, and lifestyle super-app.

SEC approves Grayscale’s Ethereum $ETH ETFs under a new “generic listing” framework.

Visa, Stripe, and Fold team up to launch a Bitcoin credit card.

US lawmakers urge SEC to enact Trump’s order opening the $12.5T 401k market to crypto.

What to Look Out For:

Vanguard explores offering crypto ETF access to brokerage clients.

BlackRock ($12.5T) files for a Bitcoin Premium Income ETF.

CFTC will allow stablecoins as collateral in U.S. derivatives markets for the first time.

Tether aims to raise $20B at a $500B valuation, rivaling OpenAI as the top private company.

SEC plans to roll out an “innovation exemption” for crypto firms by year-end.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.