- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Over the holiday week, Bitcoin’s price largely traded sideways to slightly lower, hovering around the $87,000–$89,000 area, with thin year-end liquidity and subdued trading activity. Spot Bitcoin ETFs continued to see net outflows, with U.S. products extending a multi-day withdrawal streak that amounted to hundreds of millions in redemptions over the week, particularly around Christmas Eve and Boxing Day, as investors trimmed exposure ahead of the break and tax-driven selling emerged. This ongoing ETF outflow pressure helped keep Bitcoin capped below key resistance and contributed to a cautious market tone, even as volume remained light and holiday dynamics dominated price action.

Macro:

In another holiday-shortened week, key releases will feature global December PMIs, Korean trade data for December and the FOMC’s December meeting minutes. The usual runs of weekly claims data and the ADP’s new high-frequency employment series will also be in focus Stateside.

More Crypto:

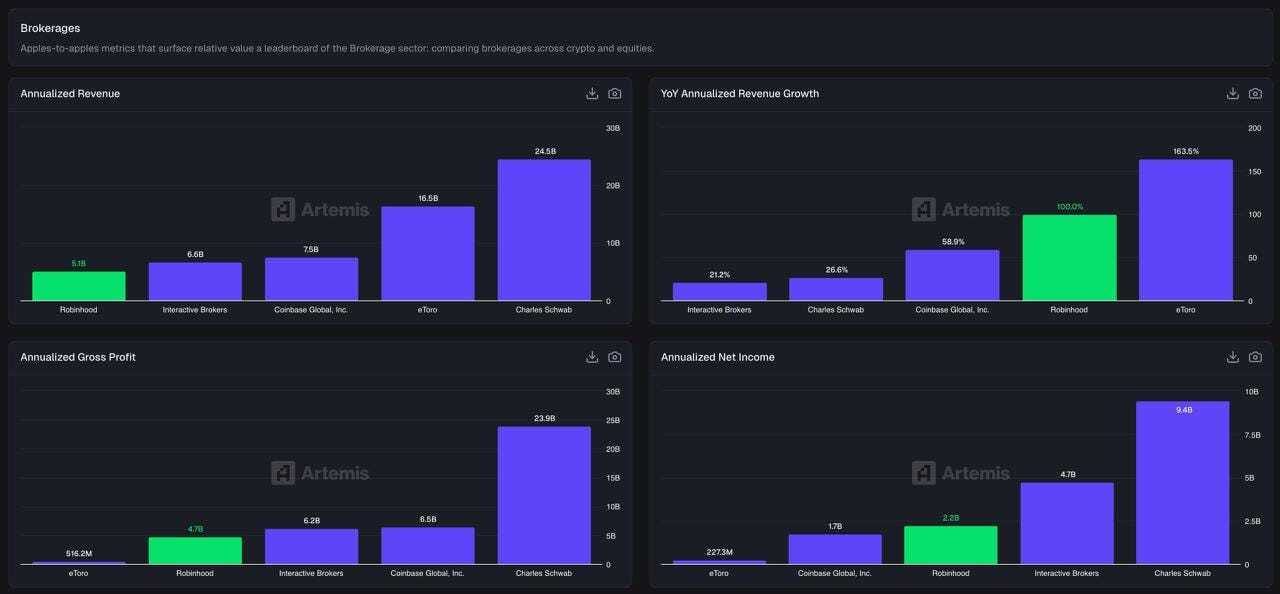

Source: Artemis

Robinhood looks expensive on multiples — #1 across EV/Revenue, EV/Gross Profit, and EV/Net Income versus peers.

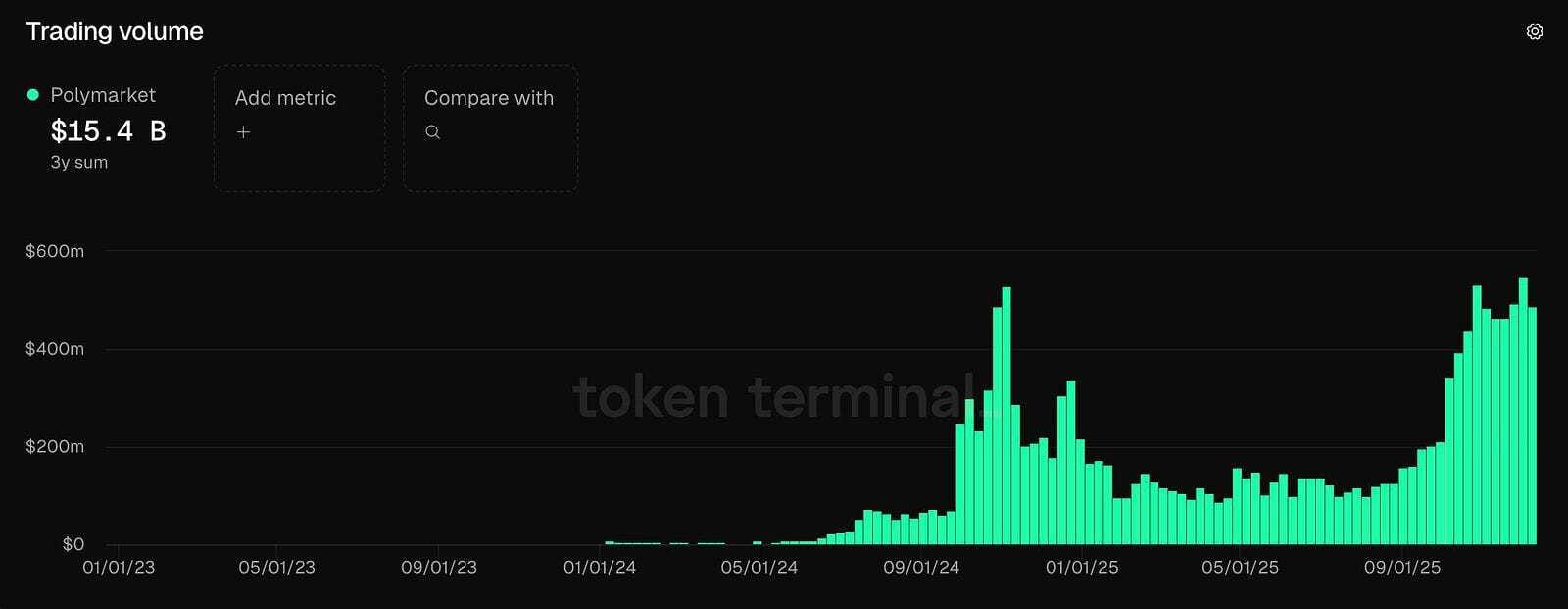

Source: Token Terminal

Prediction markets stopped being “bets” and started acting like expectation-pricing infrastructure.

Source: CryptoQuant

$NEXO on-chain activity quietly broke out in 2025.

What Happened This Week:

Strategy boosted its USD reserves by $748M, bringing totals to $2.19B and ₿671,268

ETHZilla sold $74.5M in ETH to reduce debt

Trump’s media company bought 450 BTC worth $40m

Tom Lee’s Bitmine bought 98,852 ETH ($302M) last week and now holds 4,066,062 ETH ($12.42B)

What to Look Out For:

Russia’s central bank may allow retail investors to buy crypto

US House drafts bill to exempt stablecoin transactions under $200 from capital gains tax

Metaplanet’s board approved a plan to further purchase Bitcoin

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.