- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Source: Farside, ARP Digital Research Team Q3’25

The ETF demand returned in the early week, where the U.S. spot Bitcoin ETFs saw a net inflow of $333M on September 2 and $301M on the following day. Over the week, the net flow turned to +$246M, significant yet nearly half of the previous week. In these 7 days, MARA added 705 BTC to its treasury, Strategy bought 4,048 tokens and more, showcasing continuous institutional demand. Even the regulatory developments began to move forward as the SEC and CFTC announced a joint roundtable on September 29.

More Crypto:

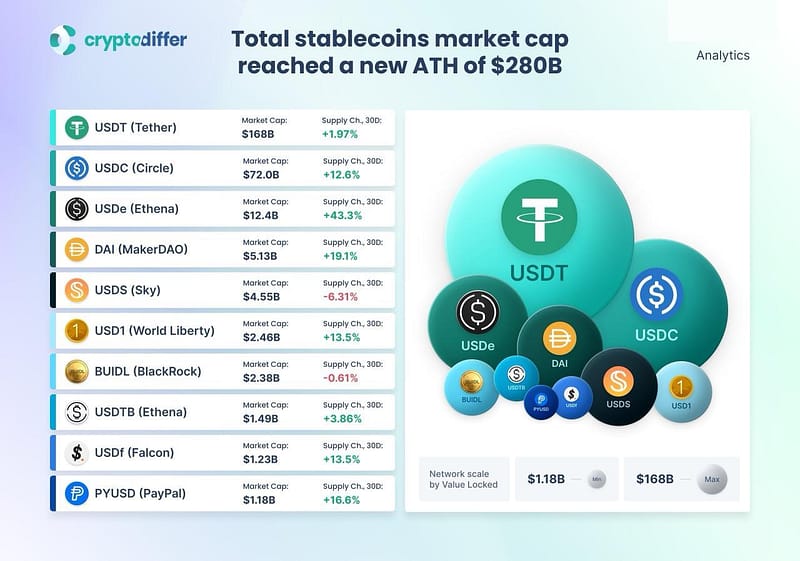

Source: Cryptodiffer

Stablecoin market cap just hit a new all-time high of $280B.

A clear sign of growing trust in digital dollar-based assets.

Source: River

Bitcoin is being accumulated by businesses at 4x the mining rate, with only ~450 BTC mined daily.

Shrinking exchange reserves and institutional hodling may trigger a bullish supply shock.

Source: The Block

Ethereum just hit a new monthly record with 51.77 million transactions in August — the highest in the network’s history.

What Happened This Week:

OndoFinance launches Ondo Global Markets, bringing 100+ tokenized U.S. stocks and ETFs to Ethereum.

World Liberty blacklists Justin Sun’s address, freezing 540M unlocked and 2.4B locked tokens, alleging exchange misuse to dump prices.

SEC & CFTC approve spot trading of select cryptocurrencies on US exchanges.

Jack Ma’s (Alibaba founder) Yunfeng Financial Group Limited buys 10,000 ETH as a reserve asset.

Metaplanet buys 1,009 BTC ($110M), now holding 20,000 BTC ($2.15B).

What to Look Out For:

Sept Fed rate cut odds surge to 99%.

SEC unveils plan to reform crypto rules.

Nasdaq will tighten scrutiny on firms raising funds to buy crypto.

Federal Reserve to host conference on stablecoins, tokenization, and AI.

Ethereumfndn will sell 10K ETH via CEX this month to fund R&D, grants, and donations.

El Salvador to host the world’s first government Bitcoin conference in November.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.