- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

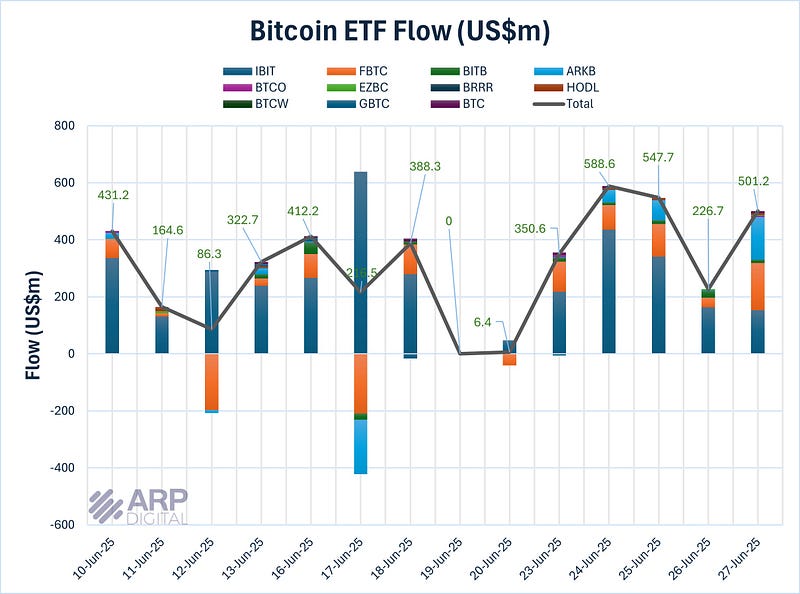

Source: Farside, ARP Digital Research Team Q3’25

U.S. spot Bitcoin ETFs recorded their highest weekly inflows in the past 30 days, with a total of $2.2 billion added. As usual, BlackRock’s IBIT ETF led the inflow momentum, attracting over $1.3 billion, followed by Fidelity’s FBTC, which pulled in $504 million. The surge in inflows signals growing institutional interest and renewed accumulation of BTC, driven by both existing players and new entrants. This sustained demand underscores market optimism and suggests that Bitcoin remains a key strategic asset amid evolving macro and geopolitical conditions.

Macro:

US economic growth will be the main focus next week with the jobs report and ISM indices due. Elsewhere, data highlights include flash CPIs in Europe as well as PMIs in China. From a monetary policy PoV, the main event will be the ECB’s forum on central banking in Sintra, featuring heads of the Fed, the ECB, the BoJ and the BoE.

More Crypto:

Source: Gabriel Halm

The amount of high-risk loans across DeFi decreased significantly over the last two weeks, driven by increased uncertainty and liquidations.

Source: Token Terminal

It seems stablecoins can’t stop breaking records.

This week, a remarkable stablecoin supply hit another ATH of $238B across multiple blockchains.

Source: CryptoQuant

The 1-year cumulative difference in the volume of purchase/sale quotes for altcoins (excluding ETH) has been falling since December 2024.

Despite the fact that BTC is growing, altcoins behave as if the market is bearish. If this indicator does not start to grow again, the alt season may not take place.

What Happened This Week:

Trump says he officially signed trade deal with China.

Pumpdotfun 2.0 is Now Live on iOS & Android.

South Korea’s top bank files stablecoin trademarks for new banking consortium.

Trump’s Truth Social files for Bitcoin & Ethereum ETF on NYSE.

Powell says banks can freely engage in crypto.

What to Look Out For:

Bakkt files $1B shelf offering, may use proceeds to buy Bitcoin.

Trump considers naming the next Fed Chair early to undermine Powell.

FHFA directs Fannie Mae & Freddie Mac to consider crypto in mortgage assessments.

Trump-backed World Liberty Financial says $WLFI will soon be transferable.

Powell says upcoming trade deals could enable the Fed to consider rate cuts.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.