- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Over the week, Bitcoin’s price stayed around the $90,000 area with choppy trading and mixed sentiment as macro uncertainty lingered. Bitcoin spot ETF flows shifted notably during the period: strong inflows at the start of the trading week, including a large gain on Jan 5 that helped support price, were followed by a streak of net outflows mid-week, with ETFs pulling significant capital from Tuesday through Friday — collectively amounting to over $600–$700 million in outflows across several days. This reversal erased some early-week optimism and reflected a risk-off pivot among institutions, even as broader market indicators and jobs data influenced sentiment and volume remained uneven toward the end of the week.

Macro:

The focus next week will be on the US inflation data for November/December (CPI — Dec, PPI — Nov, import prices — Nov), with economic activity indicators also due (Federal budget balance, NFIB survey, IP, home sales, retail sales, weekly claims, Empire PMIs). Elsewhere, notable economic data includes the monthly GDP in the UK and the trade balance in China. From a monetary policy standpoint, we have a slew of Fed speakers (incl John Williams) and the latest Beige Book due on Wednesday. The US earnings season will properly kick off on Tuesday with the initial run of US financials and Delta Airlines (relevant to consumer health).

More Crypto:

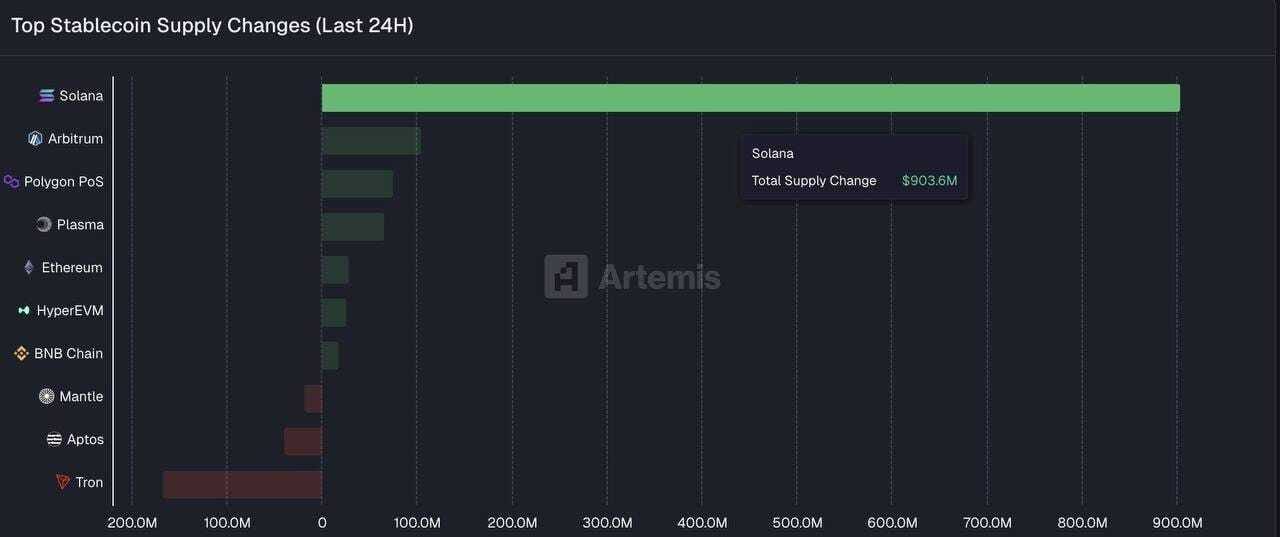

Source: Artemis

Early January saw ~$900M in stablecoins hit Solana, mostly USDC.

Source: Artemis

Stablecoins are tracking toward ~$1.6T by 2030, but the structure is already clear.

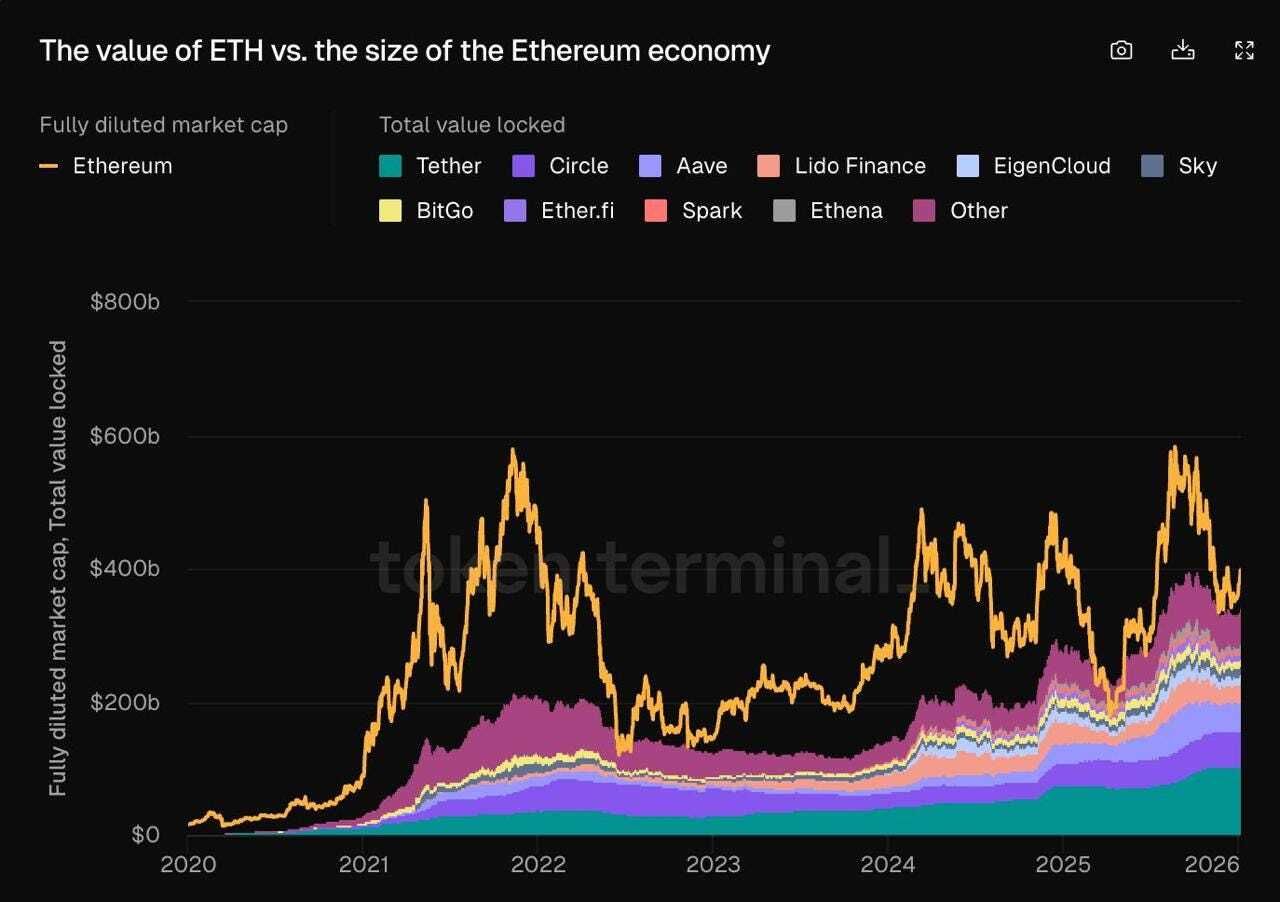

Source: Tokenterminal

For over five years, Ethereum TVL has quietly acted as a valuation floor for ETH.

What Happened This Week:

Binance Futures launches TradFi perpetuals, enabling trading of gold (XAUUSDT) and silver (XAGUSDT) contracts

Tether launches Scudo, an on-chain gold token worth 0.001 oz, alongside its $2.3B XAUT

PwC shifts strategy to crypto amid regulatory and stablecoin developments

Polymarket launches real estate prediction markets

What to Look Out For:

Morgan Stanley filed for spot Bitcoin and Solana ETFs

Morgan Stanley plans a digital wallet this year for tokenized assets

Wall Street and crypto leaders make progress on a crypto bill in a private meeting

Michael Saylor hints at more Bitcoin purchases

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.