- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

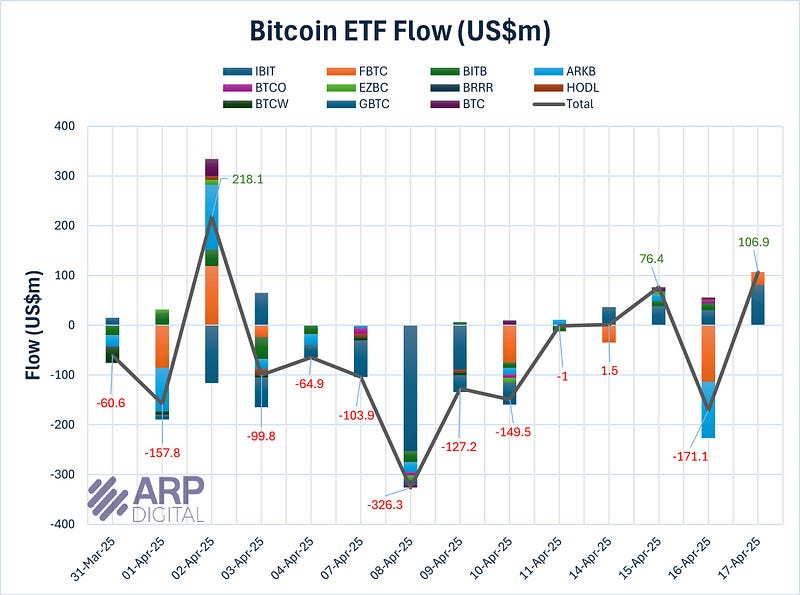

Source: Farside, ARP Digital Research Team Q2’25

Spot Bitcoin ETFs experienced a volatile week of flows. On April 14, net inflows were marginal at $1.5M, reflecting internal rotation — BlackRock added $36.7M while Fidelity pulled $35.2M. Momentum shifted on April 15 with strong net inflows of $76.4M, signaling broad institutional buying. However, this reversed sharply on April 16 with a steep net outflow of -$171.1M, as both Ark and Fidelity offloaded heavily, although BlackRock remained a steady buyer with an estimated $31M allocation. The following day, April 17, saw a swift recovery with $106.9M in net inflows — again led by BlackRock’s aggressive $80.9M buy. The pattern highlights that while short-term retail sentiment may fluctuate, institutional confidence — especially from BlackRock — remains a key stabilizing force, anchoring Bitcoin near the $85K range.

Macro:

Markets head into the week focused on a wave of key earnings and international macro data. On the earnings front, Tesla (Tue), Boeing (Wed), Alphabet and Intel (Thu), and SLB (Fri) headline a packed roster. Meanwhile, macro attention shifts overseas with Eurozone PMIs (Wed) and Tokyo CPI (Thu) likely to drive FX and rates sentiment. With the Fed blackout period starting Saturday and no major U.S. data on deck, market direction may hinge more on earnings reactions and global data surprises.

More Crypto:

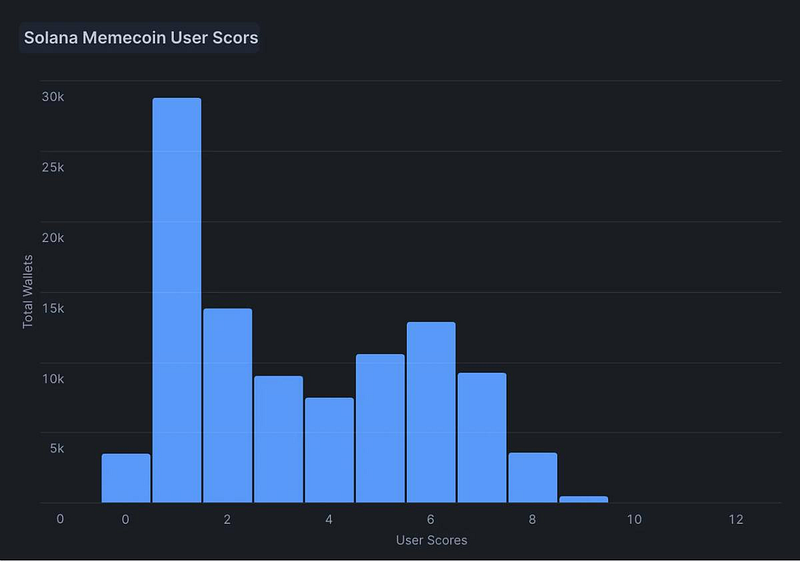

Over 60% of memecoin traders score between 0 and 4, mostly clustered at 0–1.

This means they’re not ecosystem users — just hype chasers jumping from token to token, reinvesting their gains straight back into the crypto casino.

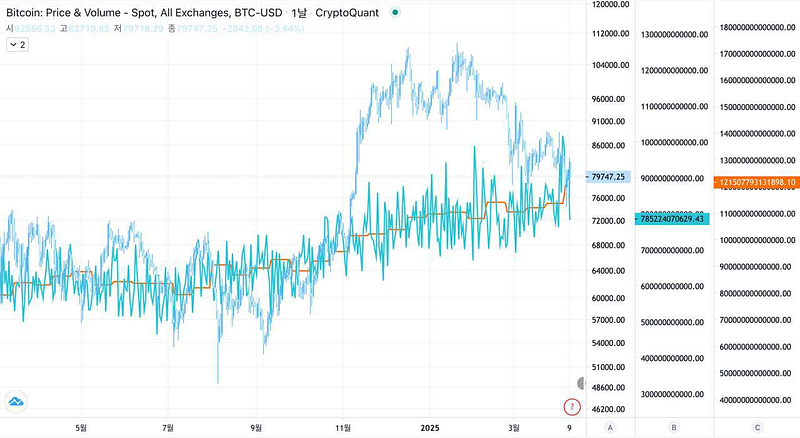

Source: Cryptoquant, Tradingview

Bitcoin slide from $109K to $80K, but the network isn’t flinching — both hashrate and mining difficulty are hitting all-time highs.

This isn’t pressure, it’s power: a signal of rising security and underlying value. Hashrate models suggest Bitcoin’s market cap could reach $5 trillion.

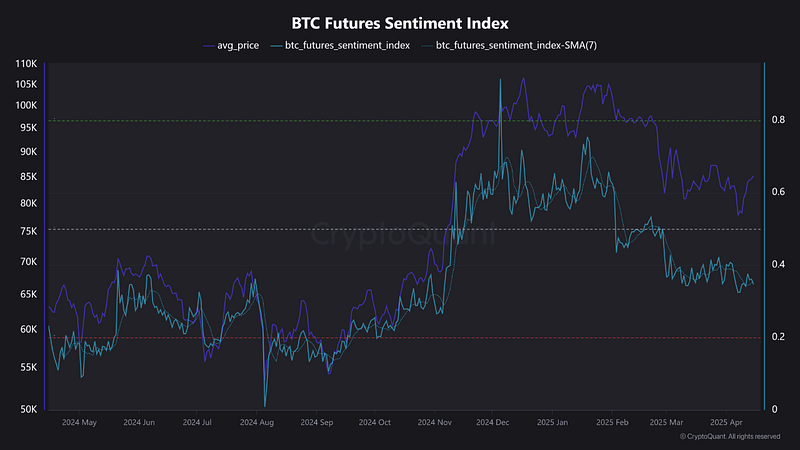

Source: abramchart

Between Nov 2024 and Feb 2025, BTC surged, but futures sentiment peaked briefly and then declined — a sign of caution or profit-taking. Since Feb, sentiment has steadily dropped despite prices holding around $70K–$80K, indicating market fear or waning interest.

The sentiment index shows resistance near 0.8 and support at 0.2, currently hovering around 0.4 — a bearish signal. This divergence suggests possible consolidation or downside risk unless a strong catalyst shifts sentiment.

What Happened This Week:

Canary files Staked.

Russian Finance Ministry calls for a national crypto stablecoin.

SEC delays decision on staking for Grayscale’s spot $ETH ETF.

Binance is resumed services and withdrawals after a temporary AWS outage.

MicroStrategy Buys 3,459 BTC for $285.8M at $82,618 Avg Price.

Mantra ($OM) Crashes over 90% within hours.

What to Look Out For:

Trump says talks with China are going well.

Trump is studying whether he can fire fed chair Powell.

Several unnamed governments and sovereign wealth funds have approached Binance to help set up crypto reserves.

Fed’s Powell expects relaxed bank rules on crypto and stablecoins as they gain mainstream adoption.

Token2049 Dubai kicks off April 30 — May 1, bringing together over 15,000 attendees, 200+ speakers, and 500+ side events.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.