- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

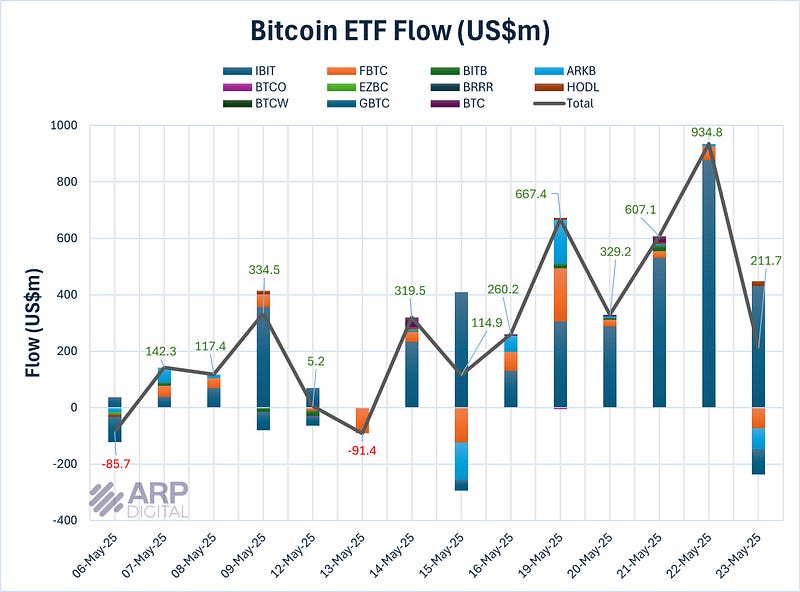

Source: Farside, ARP Digital Research Team Q2’25

A major driver behind Bitcoin’s recent price surge was the sustained buying activity from institutional investors through spot Bitcoin ETFs. The week recorded net inflows on all five trading days, marking the eighth straight day of ETF accumulation. BlackRock led the charge, having an inflow of over $2.4 billion worth of BTC throughout the week. The most significant inflow occurred on May 22, totaling approximately $934.8 million, which aligns with the data as the highest single-day ETF inflow in the past four months. Other notable entities such as Strategy, Metaplanet, and Tether continued accumulating despite broader macroeconomic uncertainties. This strong institutional demand not only supported Bitcoin’s upward price momentum but also signaled to corporations and even governments that digital assets are becoming a legitimate component of strategic reserves. The momentum driven by ETF inflows reflects a broader shift in traditional finance, where Bitcoin is increasingly viewed as a long-term store of value.

Macro:

Next week, markets will focus on key U.S. data, especially Friday’s PCE inflation report, which could shape expectations for Fed rate cuts. Fed speakers, consumer confidence, and jobless claims will also be in focus. Recent tariff developments, including proposed measures affecting key tech and manufacturing sectors, are adding uncertainty around trade policy and inflation. While global data like Canada and India GDP and Eurozone inflation are due, U.S. signals are expected to dominate the market narrative.

More Crypto:

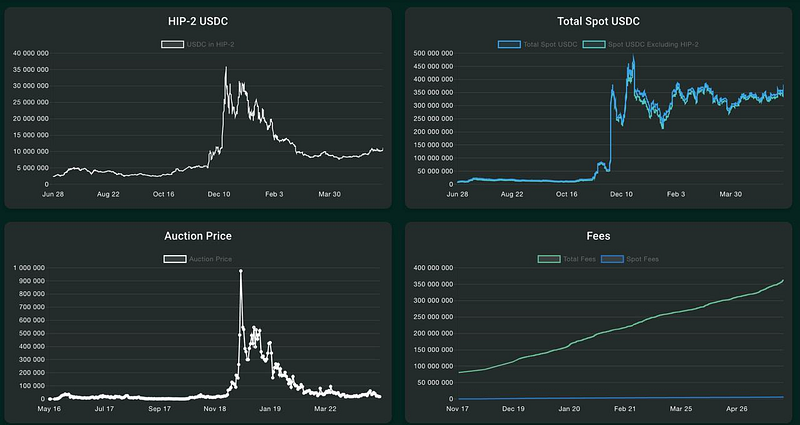

Source: hypurrscan

Hyperliquid hit all-time highs with $8.92B in open interest and $18.91B in 24-hour trading volume.

It now ranks 5th globally, right behind Binance, Bitget, Bybit, and OKX.

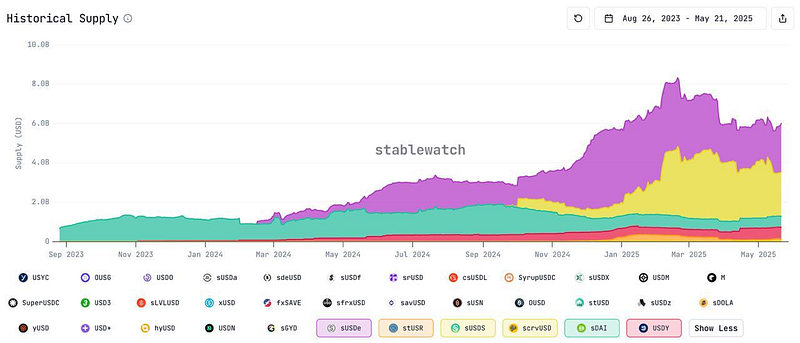

Source: Stablewatch

Yield-bearing stablecoins have grown from $1.5B to $11B in circulation since early 2024.

Their share of the stablecoin market has jumped from 1% to 4.5%, and the momentum isn’t slowing down.

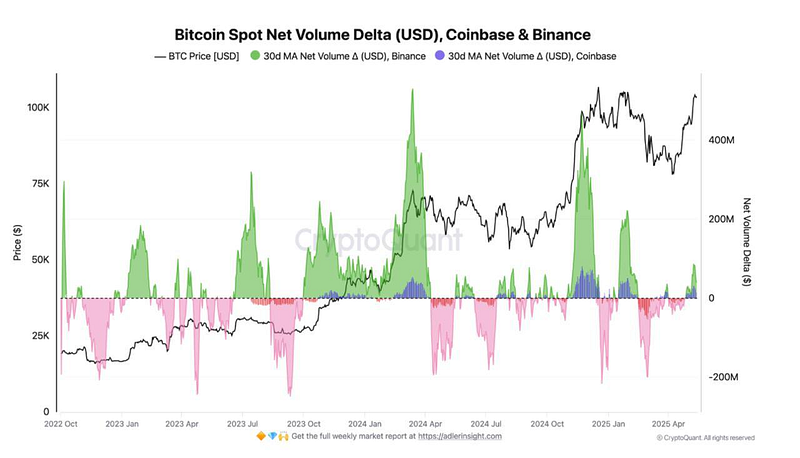

Source: CryptoQuant

BTC’s net spot volume delta on Binance flipped positive, indicating growing buy-side strength and easing sell pressure, even above $100K.

However, history shows that sharp spikes in spot volume often precede local market tops, so caution may be warranted.

What Happened This Week:

Bitcoin surpasses Amazon and Google, now the 5th largest global asset.

FIFA partners with Avalanche (AVAX) to build its own blockchain.

Cetus Protocol on Sui Network has been hacked, with losses exceeding $200 million.

NasdaqBTCS bought 3,450 ETH for $8.42 million, boosting holdings to approximately 12,500 ETH, up 38% since Q1 2025.

Texas passes the Strategic Bitcoin Reserve Bill SB21.

The Senate passes the “GENIUS Act” stablecoin bill with over 60 votes.

1.1% of all USD is now tokenized as stablecoins.

What to Look Out For:

Trump says the EU asked for an extension, and he agreed to move the date to July 9.

Saylor hints at buying more Bitcoin.

Trump proposes a 25% tariff on iPhones not made in the U.S.

MicroStrategy revealed plans to sell up to $2.1 billion in 10% preferred stock.

Robinhood proposes SEC rules to regulate tokenized real-world assets, eyeing a $30 trillion onchain market.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.