- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

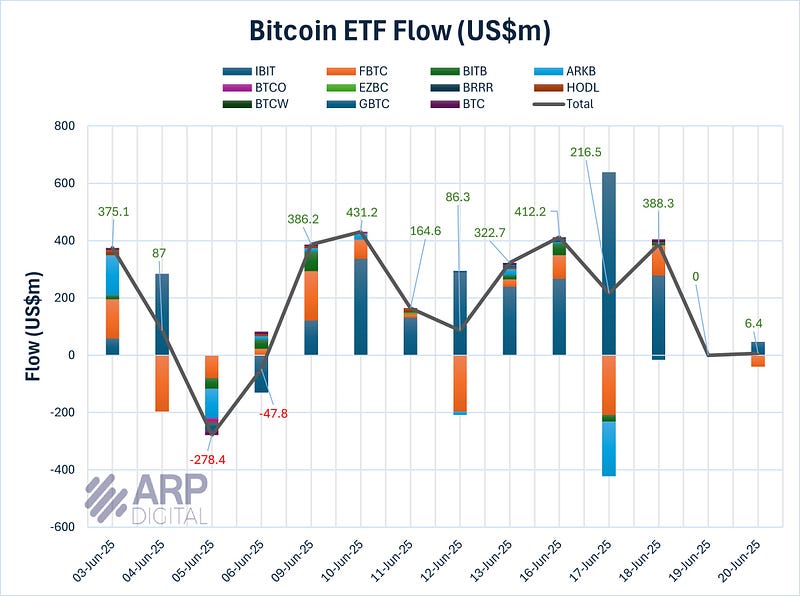

Source: Farside, ARP Digital Research Team Q3’25

Despite price volatility, U.S. Bitcoin ETFs recorded a second consecutive week of net inflows, adding over $1 billion and pushing the 10-day total to $2.4 billion. This ranks just behind the record-setting periods at the end of May ($3.2 billion) and April ($3 billion). BlackRock’s IBIT once again led the way, accounting for $1.1 billion in inflows during this stretch. Institutional interest remains strong, with companies such as MicroStrategy and Metaplanet acquiring $1.22 billion and $234 million in Bitcoin respectively in June. The MicroStrategy model is increasingly being adopted by other public firms, though analysts caution that a shift in market sentiment could pose risks. While macroeconomic headwinds remain, strong institutional accumulation and ETF demand continue to underpin Bitcoin’s long-term narrative, even as short-term price action stays volatile.

Macro:

The latest developments in the Israel-Iran conflict and whether the Iranians will strike back is the key event in the foreseeable future. Against this backdrop, the NATO summit will be held in The Hague on June 24–25 while China’s June Politburo meeting is also scheduled this week. The focus will also be on monetary policy, with Fed’s Chair Powell’s testimonies to Congress on Tuesday and Wednesday as key events. In economic data, highlights include the global flash PMIs for June on Monday and inflation prints in the US (PCE deflators), Europe and Japan (the Tokyo CPI) on Friday.

More Crypto:

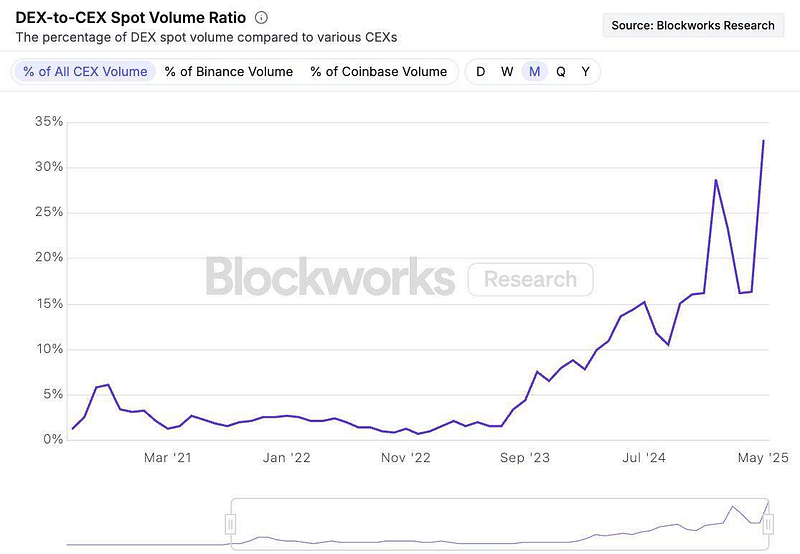

Source: Blockworks

Last month DEX volumes showed another ATH, however, most of the activity was driven by Binance’s incentive program that was launched on BNB.

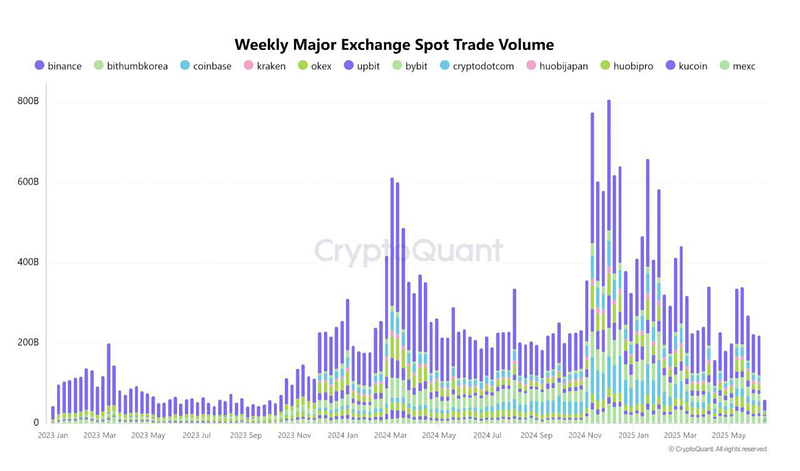

Source: CryptoQuant

Despite the fact that the price of Bitcoin is close to historical highs, trading volume on exchanges remains at multi-year lows, indicating that the appetite for trading remains low.

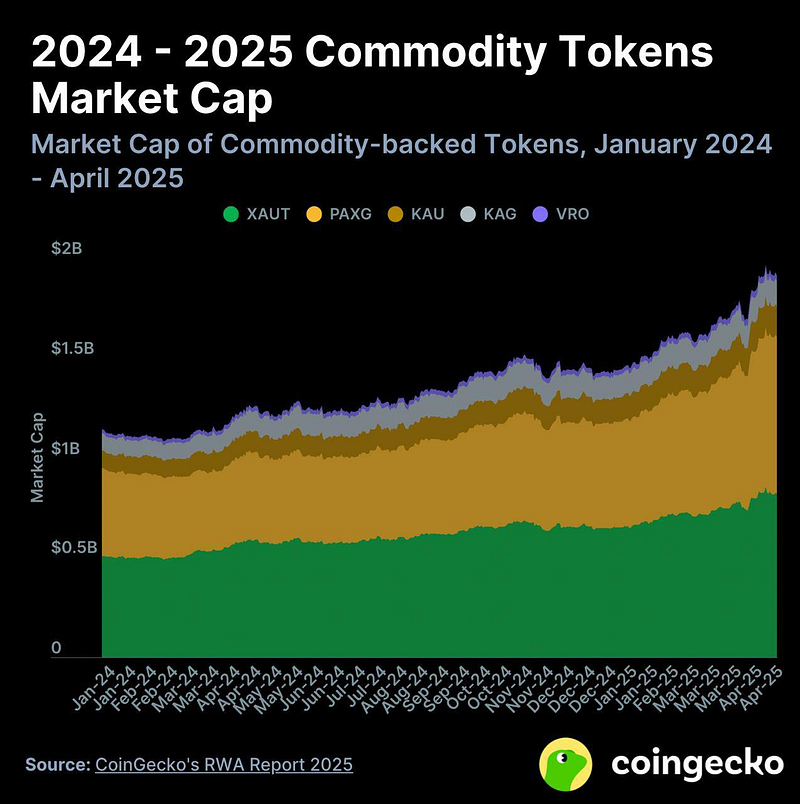

Source: Coingecko

Commodity-backed tokens grew by +67.8% between 2024 and 2025, adding $773.9 million to the market capitalization.

This surge led to the fact that it reached an ATH of $1.9 billion against the background of uncertain global economic prospects.

What Happened This Week:

Parataxis acquires Bridge Biotherapeutics for $18.5M to launch a Bitcoin treasury platform in Korea.

Coinbase secures EU license to offer crypto services.

Trump said that digital assets are the future and vowed that the U.S. will lead in this space.

Yellow Card, Visa to Expand Stablecoin Use in Emerging Markets.

Senate secures enough votes to pass stablecoin bill.

What to Look Out For:

Iran approves closing the Strait of Hormuz after US strikes, threatening 20% of global oil flow.

Bloomberg ups spot crypto ETF approval odds to 90%+.

Pumpfun’s token auction and listing, set for June 25, is delayed to mid-July.

Fed’s Waller says rate cuts may start in July.

jpmorgan ($JPM) reportedly trademarks ‘JPMD’ stablecoin.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.