- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Over the week, Bitcoin and its spot ETFs saw renewed weakness in flows, with U.S. spot Bitcoin ETFs posting significant net outflows — around $1.3 billion over the four trading days through Friday — the worst weekly showing in nearly a year, as sentiment shifted back toward risk-off and some institutional holders trimmed exposure. Meanwhile the broader price action reflected this pressure, with Bitcoin struggling to hold key levels amid geopolitical and macro uncertainty. Capital also rotated within the crypto ETF space, with some smaller altcoin products attracting modest inflows even as BTC and Ether funds bled capital. Overall, the macro backdrop and flow reversal capped upside for Bitcoin and underscored the stop-start nature of institutional demand this month.

Macro:

The focus will be on the Fed’s decision on Wednesday, with central banks in Canada and Sweden also setting rates. Data highlights will include the preliminary January CPI prints and Q4 GDP reports in Europe and Taiwan. Corporate earnings include Apple, Microsoft and Meta in the US and ASML, LVMH and SAP in Europe.

More Crypto:

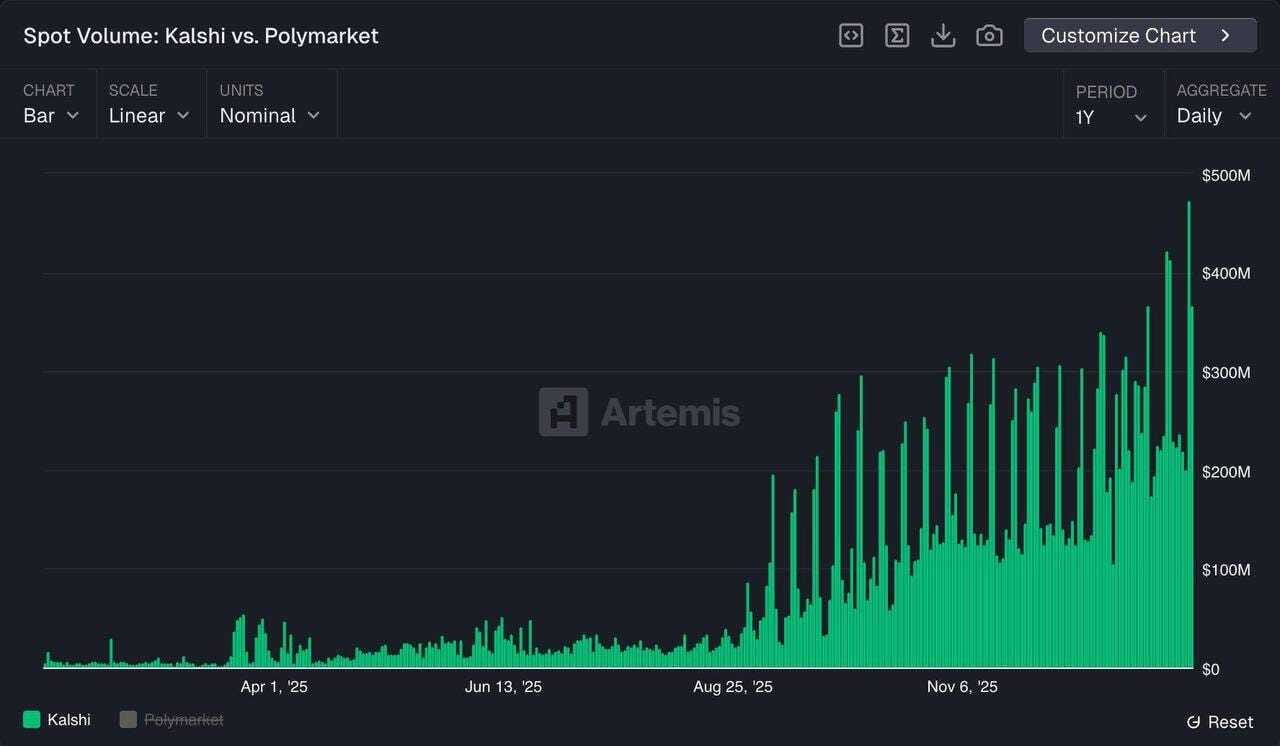

Source: Artemis

Kalshi just hit a new spot ATH.

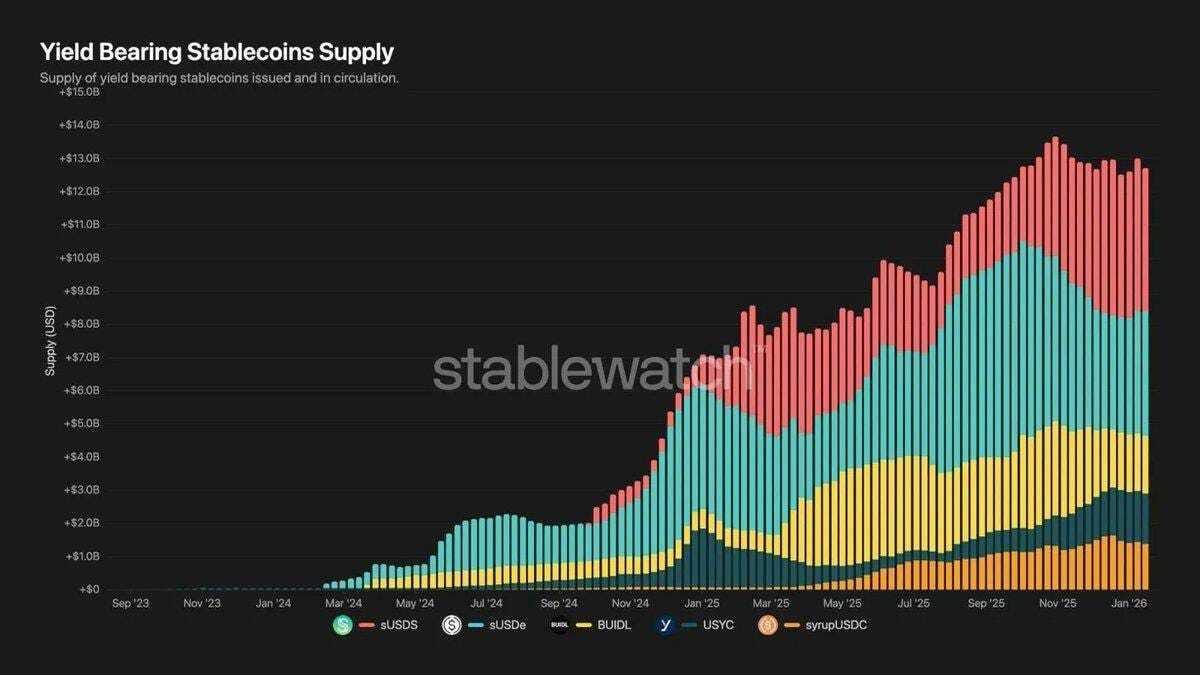

Source: Stablewatch

Yield-bearing stablecoins quietly went parabolic.

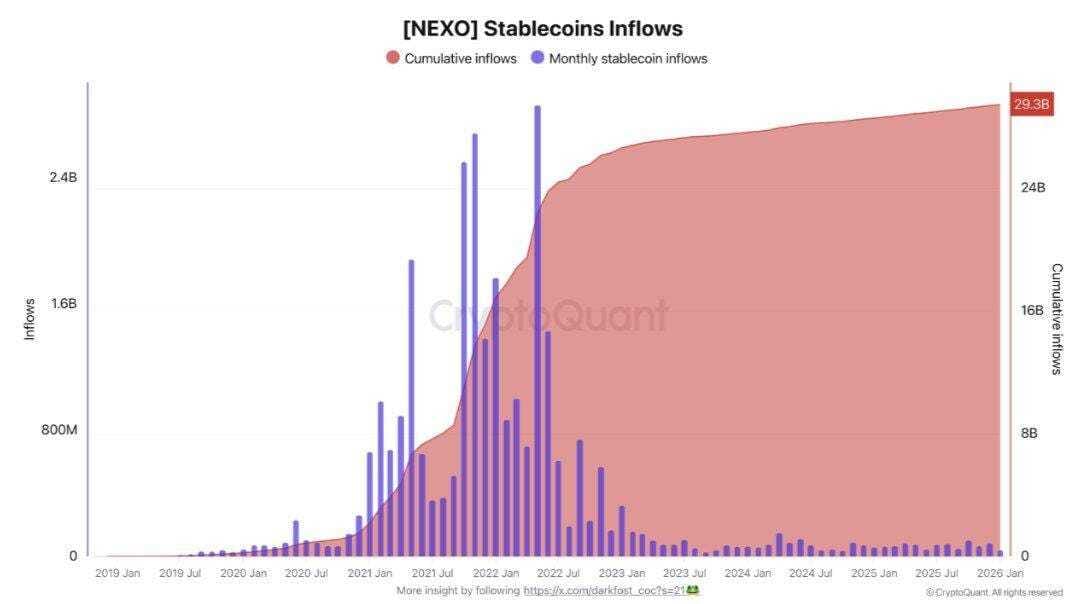

Source: CryptoQuant

Nexo saw sustained $2B+ monthly stablecoin inflows back in 2021–22, cooled during 2023, but never really lost usage.

What Happened This Week:

NYSE launches 24/7 platform for tokenized U.S. equities and ETFs with instant on-chain settlement

Saylor buys 22,305 BTC for ~$2.13B at ~$95,284 per BTC

Tom Lee’s BitMine buys 35,628 ETH

Trump cancels EU tariffs after reaching Greenland deal framework

What to Look Out For:

Mastercard considers strategic investment in Zerohash after acquisition talks fall through

Trump says his priority is making the U.S. the crypto capital of the world and plans to sign the crypto market structure bill soon

Binance founder CZ says he’s in talks with multiple governments on asset tokenization

UBS plans to offer crypto investing to select private banking clients

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.