- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

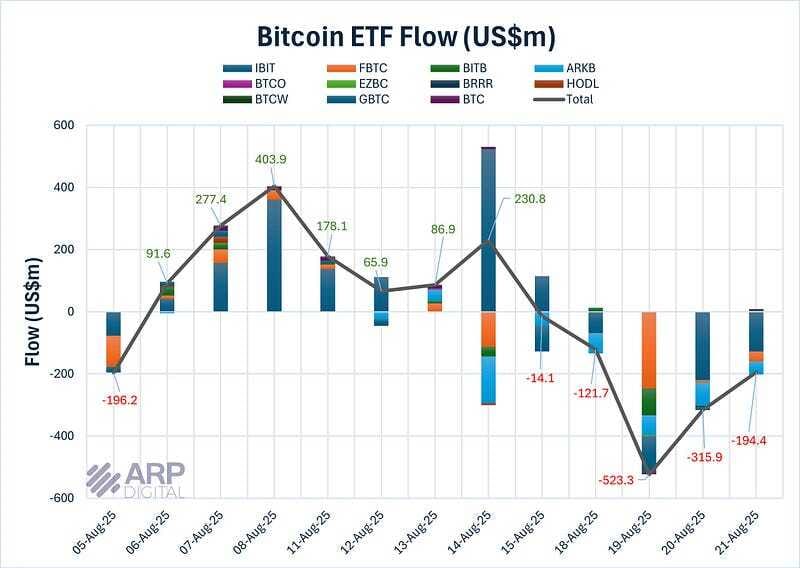

Source: Farside, ARP Digital Research Team Q3’25

US BTC-spot ETF market outflows weighed on investor sentiment after Friday’s Powell-induced rally. Key flows for the week ending August 22 included:

iShares Bitcoin Trust (IBIT) reported weekly net outflows of $615 million, the first since April 2025.

Fidelity Wise Origin Bitcoin Fund (FBTC) had net outflows of $235.3 million.

ARK 21Shares Bitcoin ETF (ARKB) saw net outflows of $182.3 million.

In total, seven spot ETF issuers reported net outflows in the week, leading to total weekly net outflows of $1.179 billion. Crucially, a six-day outflow streak left the BTC-spot ETF market with a $1.19 billion deficit for August, weighing on BTC demand.

Macro:

Inflation will be in focus next week with the July PCE out in the US, preliminary August CPIs due in Europe and the Tokyo CPI in Japan. Consumer confidence indicators will also be released for several G-7 economies alongside Q2 GDP in India and the secondary reading in the US. With respect to monetary policy, the BoK meets on Thursday, the ECB will publish the account of its July meeting on the same day, and Fed Gov Waller’s speech will also be worth keeping an eye on. Earnings season continues to chug along this week with a handful of major names on the docket including PDD, Nvidia, Snowflake, Crowdstrike, HP, Marvell, Dell and Alibaba.

More Crypto:

Source: Cryptorank

BNB Chain’s TVL has climbed to $13.4B, its highest level since 2022.

Active addresses have stayed above 14M for nine straight weeks, and $BNB trades just 3% below its all-time high, even as most tokens have already pulled back.

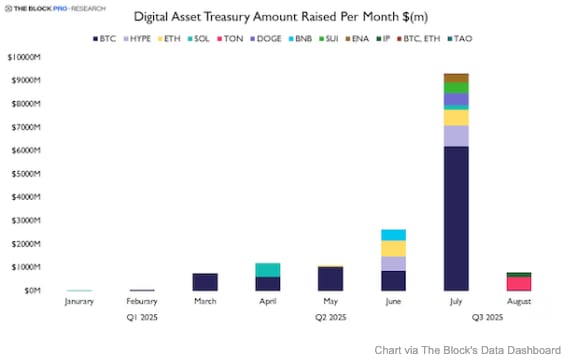

Source: The Block

Digital asset treasuries have become the leading driver of crypto capital allocation in 2025.

So far, companies have raised over $15B, outpacing traditional venture funding.

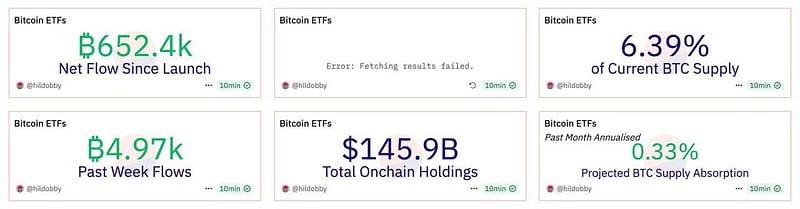

Source: Dune

According to Dune data, BTC ETFs currently hold 6.38% of total Bitcoin supply, while ETH ETFs account for 5.08% of all ETH.

At the current pace, ETH ETFs are on track to surpass BTC ETFs by September.

What Happened This Week:

DOJ clarifies it won’t charge DeFi developers unless intent to commit a crime is proven.

SEC Chair Paul Atkins says most crypto tokens aren’t securities and seeks to protect the industry from regulatory overreach.

Goldman Sachs estimates the crypto stablecoin market could reach trillions of dollars.

China is exploring yuan-backed stablecoins to increase global use of its currency.

Tether names former White House Crypto Council exec Bo Hines as Strategic Advisor for U.S. digital assets strategy

What to Look Out For:

Fed Chair Powell says current conditions “may warrant” rate cuts.

EU fast-tracks digital euro plans, eyeing rollout on Ethereum or Solana.

MetaMask will launch mUSD this year on Ethereum and Linea, spendable via MetaMask Card at Mastercard merchants.

Japan’s FSA approves first yen stablecoin.

SEC Chair Paul Atkins says the U.S. is mobilizing to become the world’s crypto capital.

Fed to end program overseeing banks’ Bitcoin, crypto, and fintech activities.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.