- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Over the past week, Bitcoin enjoyed a strong rebound in institutional interest, with spot Bitcoin ETFs swinging back into significant net inflows, reversing earlier outflow pressure and marking one of the biggest weekly demand surges in months. A large portion of this capital was directed into major products like BlackRock’s IBIT, helping lift flows into the billions and supporting Bitcoin’s price momentum near mid-$90,000s to high-$90,000s. While there was a notable single day with some redemptions, the overall trend was clearly positive, reflecting renewed institutional confidence and portfolio rebalancing after early January selling. The broader crypto market also reflected this renewed appetite, seeing strength in other ETF categories such as Ethereum, though Bitcoin ETF flows remained the headline driver of sentiment and liquidity.

Macro:

The focus next week will be on the WEF annual meeting in Davos over January 19–23 (President Trump is scheduled to give a special address on Wednesday while President Lagarde is also expected to speak at the event on Wednesday and Friday). Wednesday will also see SCOTUS hear arguments in the Lisa Cook case. The US is closed on Monday for Martin Luther King Jr. Day. Economic data highlights will include inflation gauges in the US, UK, Japan and Canada, global flash PMIs, and China’s Q4 GDP release. In monetary policy, the main event will be the BoJ decision on Friday. The FOMC is in blackout.

More Crypto:

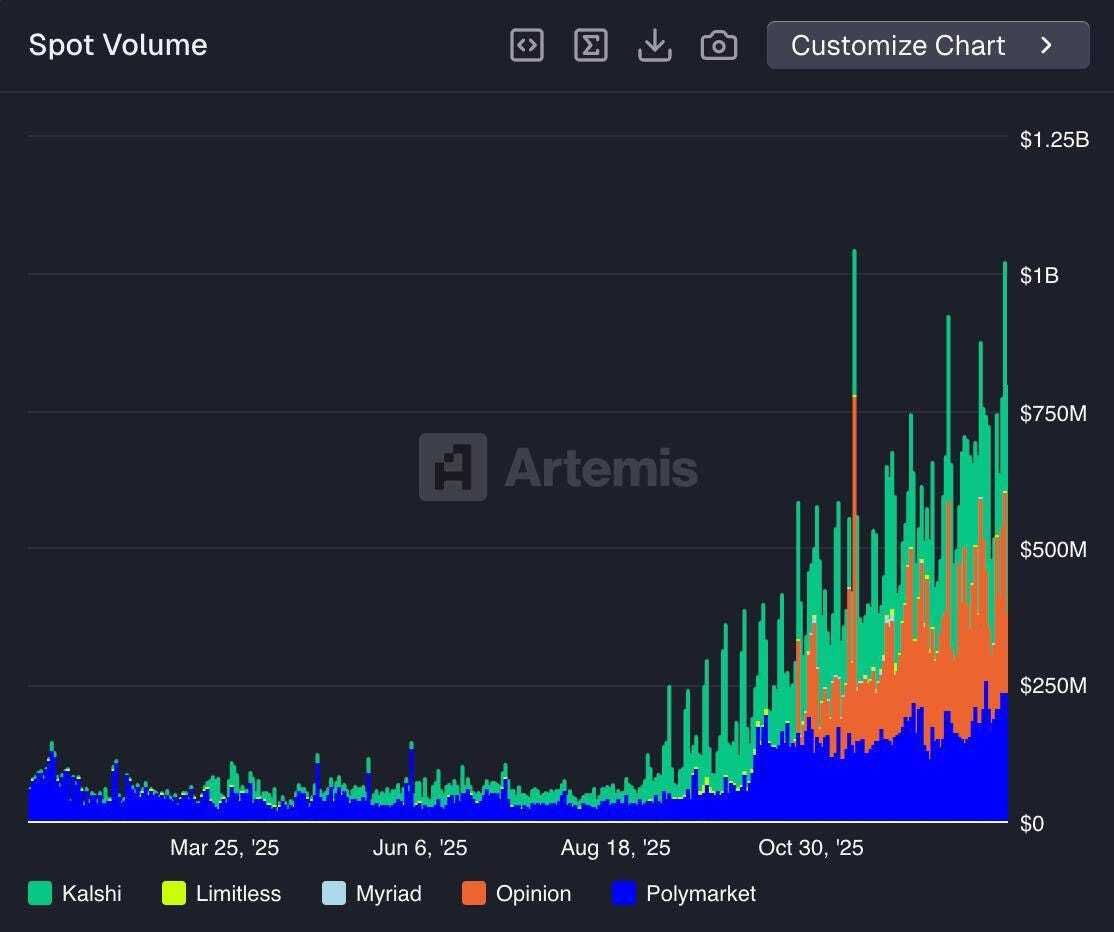

Source: Artemis

Kalshi just printed a new weekend ATH: $837M in volume, powered by the NFL playoffs.

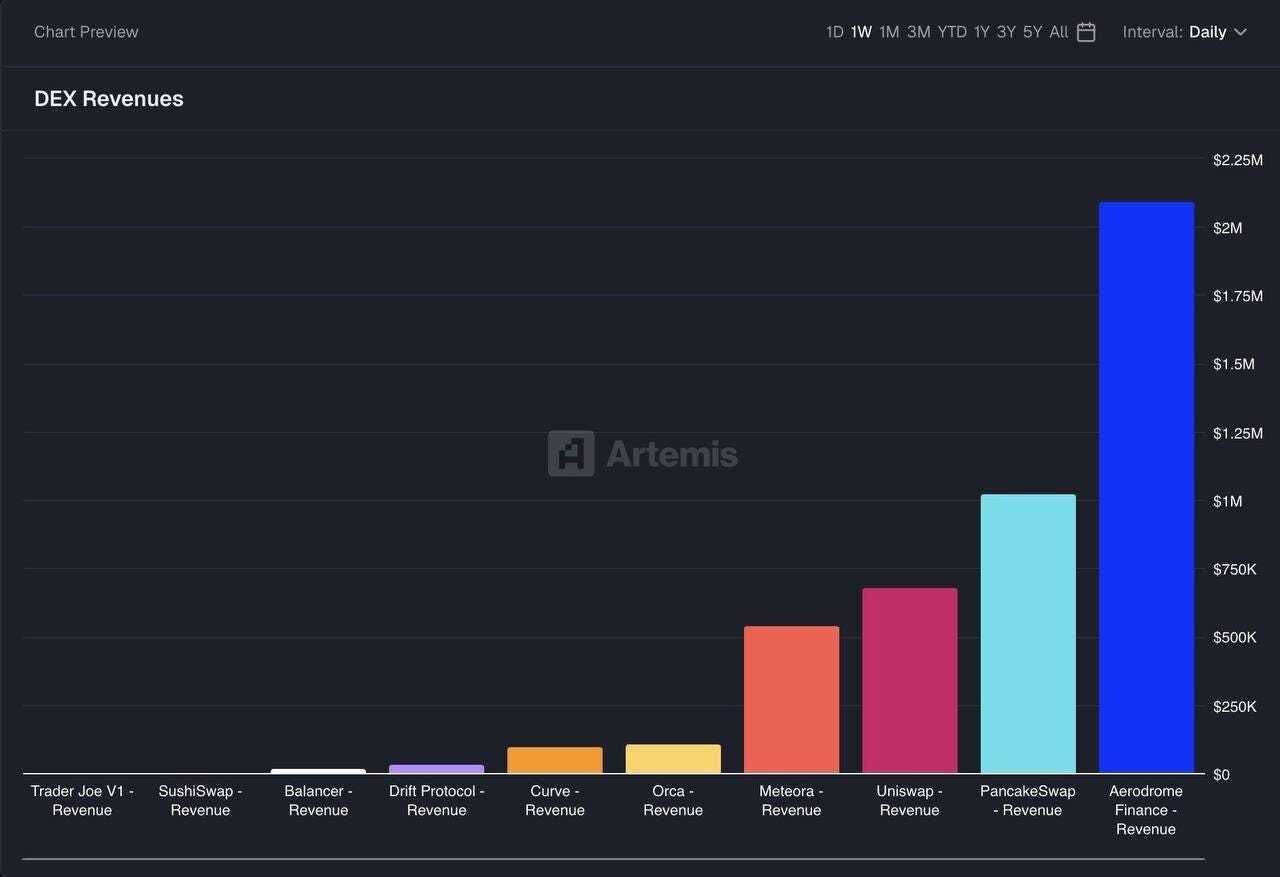

Source: Artemis

Uniswap finally flipped the fee switch on parts of the stack.

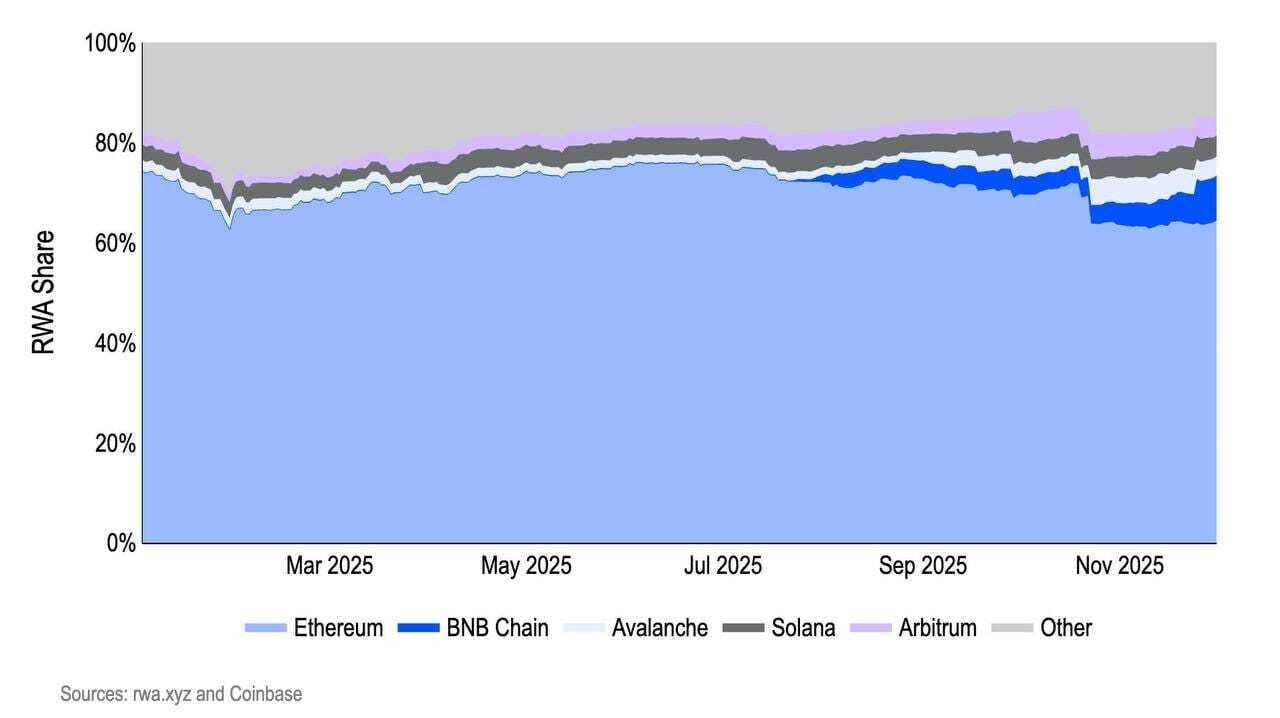

Source: Rwa

Ethereum still acts as the settlement hub for institutional RWAs, but the footprint is spreading.

What Happened This Week:

Trump slaps 10% tariffs on European countries to pressure Greenland sale

South Korea ends 9-year ban on crypto

Dubai bans privacy tokens and tightens stablecoin rules in crypto regulatory overhaul

Strategy buys 13,627 BTC for $1.25B (~$91.5K each)

What to Look Out For:

EU readies $100B in tariffs and restrictions on US firms over Greenland dispute

Goldman Sachs says it’s spending “a lot of time” on crypto, tokenization, and stablecoins

Interactive Brokers launches 24/7 USDC funding, with more stablecoins coming soon

Bitmine invests $200M in MrBeast’s Beast Industries

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.