- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

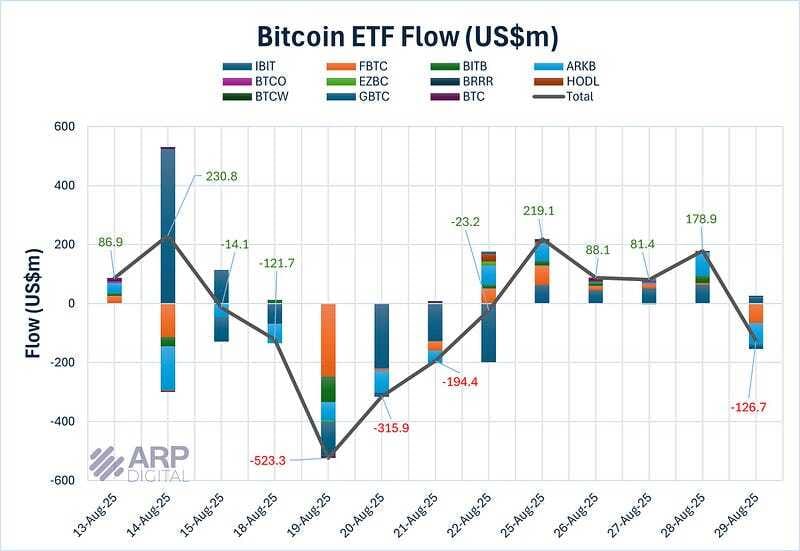

Source: Farside, ARP Digital Research Team Q3’25

Spot Bitcoin ETFs also recorded their first daily decline since August 22 with $126.64 million in outflows on Friday. As a result, their total assets under management dropped to $139.95 billion.

However, not every issuer felt the pressure with Bitcoin. Fidelity’s FBTC led the exodus with $66.2 million, followed by ARKB’s $72.07 million and GBTC’s $15.3 million in outflows. On the other hand, BlackRock’s IBIT still managed $24.63 million in inflows and WisdomTree’s BTCW drew in $2.3 million amid the wider outflows.

The underlying cause of the outflows can be attributed to investors digesting the latest data on inflation released on Friday. Notably, the US core Personal Consumption Expenditures (PCE) index climbed 2.9% year-over-year in July, the fastest pace since February, creating fears that the Federal Reserve may hold off on rate cuts.

Macro:

The US jobs report for August will be the main highlight next week (due Friday), whilst the ISM indices and the Fed’s Beige Book will also be in focus. In keeping with monetary policy, BoJ Deputy Governor Himino and Governor’s Lagarde and Bailey are also due to speak. We should receive some clarity on Cook’s legal situation on Tuesday when further filings are expected. Elsewhere, notable indicators will include inflation in Europe, wages in Japan and the PMIs in China.

More Crypto:

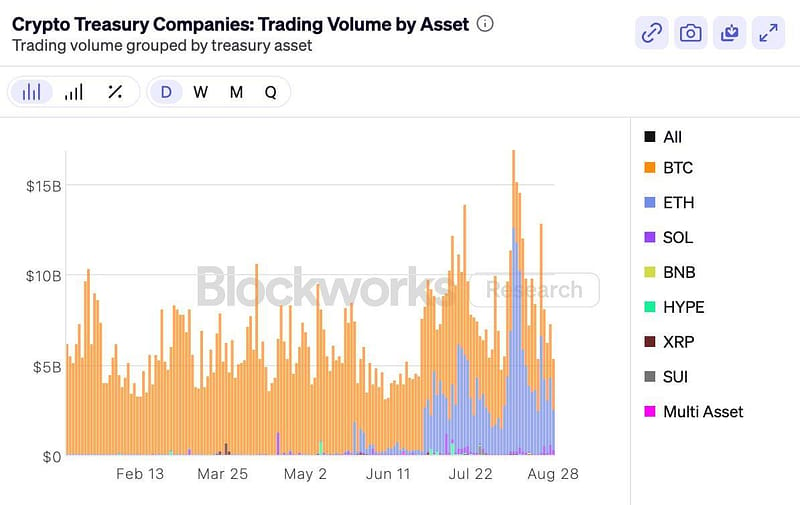

Source: Blockworks

Trading volumes of ETH of treasury companies this summer increased almost 114 times compared to the beginning of the year.

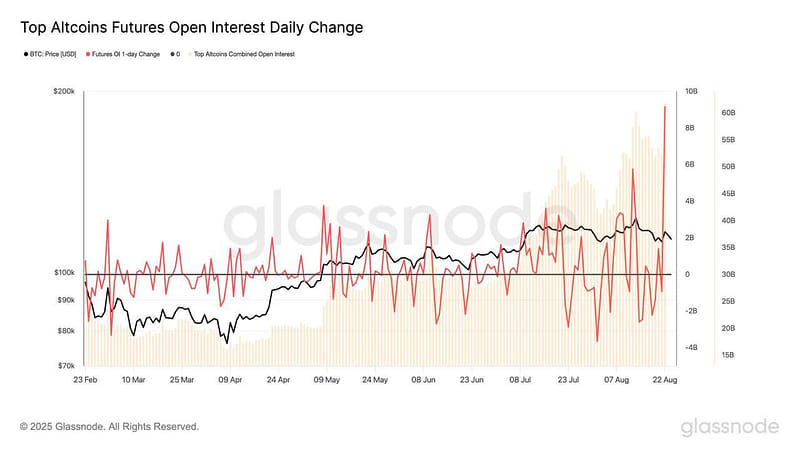

Source: Glassnode

Altcoin futures open interest jumped by $9.2B in a single day, hitting a new ATH of $61.7B.

The surge underscores how altcoins are driving leverage, volatility, and fragility across the market.

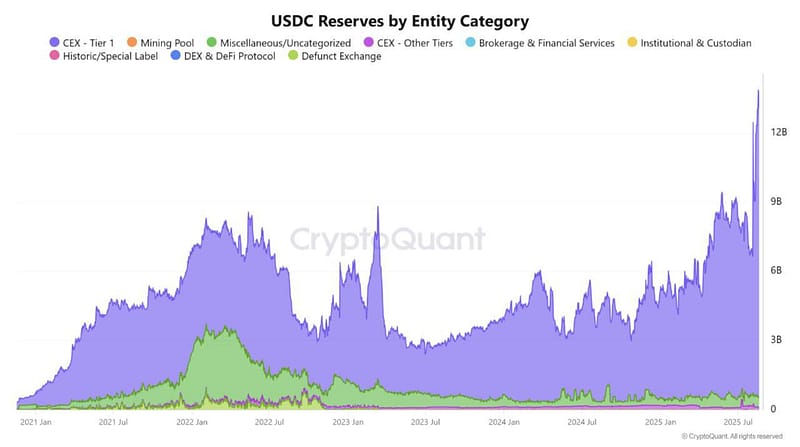

Source: CryptoQuant

USDC reserves on Tier-1 CEXs nearly doubled in under two weeks, hitting a new all-time high.

Coinbase and Kraken saw strong inflows, while Binance managed outflows with a swift $2.4B USDT entry, further reinforcing its stablecoin dominance.

What Happened This Week:

US Commerce Dept. starts publishing GDP data on Bitcoin, Ethereum & Solana.

US Commerce Dept. partners with Chainlink $LINK to put macroeconomic data on-chain.

Former Thai PM Thaksin met Bitcoin firms to discuss a national BTC reserve.

Mastercard and Circle expand partnership for USDC/EURC settlement in EEMEA.

What to Look Out For:

CFTC to clarify rules allowing US users to trade on offshore crypto exchanges.

Metaplanet to raise $880M through share offering for new Bitcoin purchases.

Philippines proposes 10,000 BTC reserve with 20-year lockup.

LayerZero Foundation’s proposal to acquire Stargate (STG) has officially passed.

Fed Chair Powell says current conditions “may warrant” rate cuts.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.