- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Over the past week, Bitcoin and its associated ETFs continued to feel pressure from weak institutional demand, with U.S. spot Bitcoin ETFs posting notable net outflows, extending a multi-week streak of capital exiting products and highlighting ongoing risk-off sentiment among larger investors. Mid-week saw especially heavy withdrawals from Bitcoin ETF funds, which mirrored broader market weakness as Bitcoin’s price struggled to hold key supports amid volatility. However, there were pockets of inflows later in the week, including a significant one-day recovery in ETF buying that helped dampen the selling pressure and provided a temporary boost to Bitcoin’s price. The overall picture was one of mixed flows and cautious sentiment, with outflows broadly outweighing inflows but institutional interest not vanishing entirely as some buyers stepped back in toward the week’s end.

Macro:

Next week’s focus will be on the delayed US jobs report as well as the rescheduled CPI release. Inflation reports are also due in China and several European countries. Elsewhere, there will be the Q4 GDP in the UK and the Lower House election in Japan tomorrow. The Munich Security Conference will kick off on Friday. With respect to monetary policy, the CBE has its first decision of the year on Thursday. Meanwhile, several FOMC & ECB officials are on the docket with speeches. Major corporate earnings will include UniCredit, Cisco, Coca-Cola, Siemens, BP, Datadog, AppLovin and NetEase.

More Crypto:

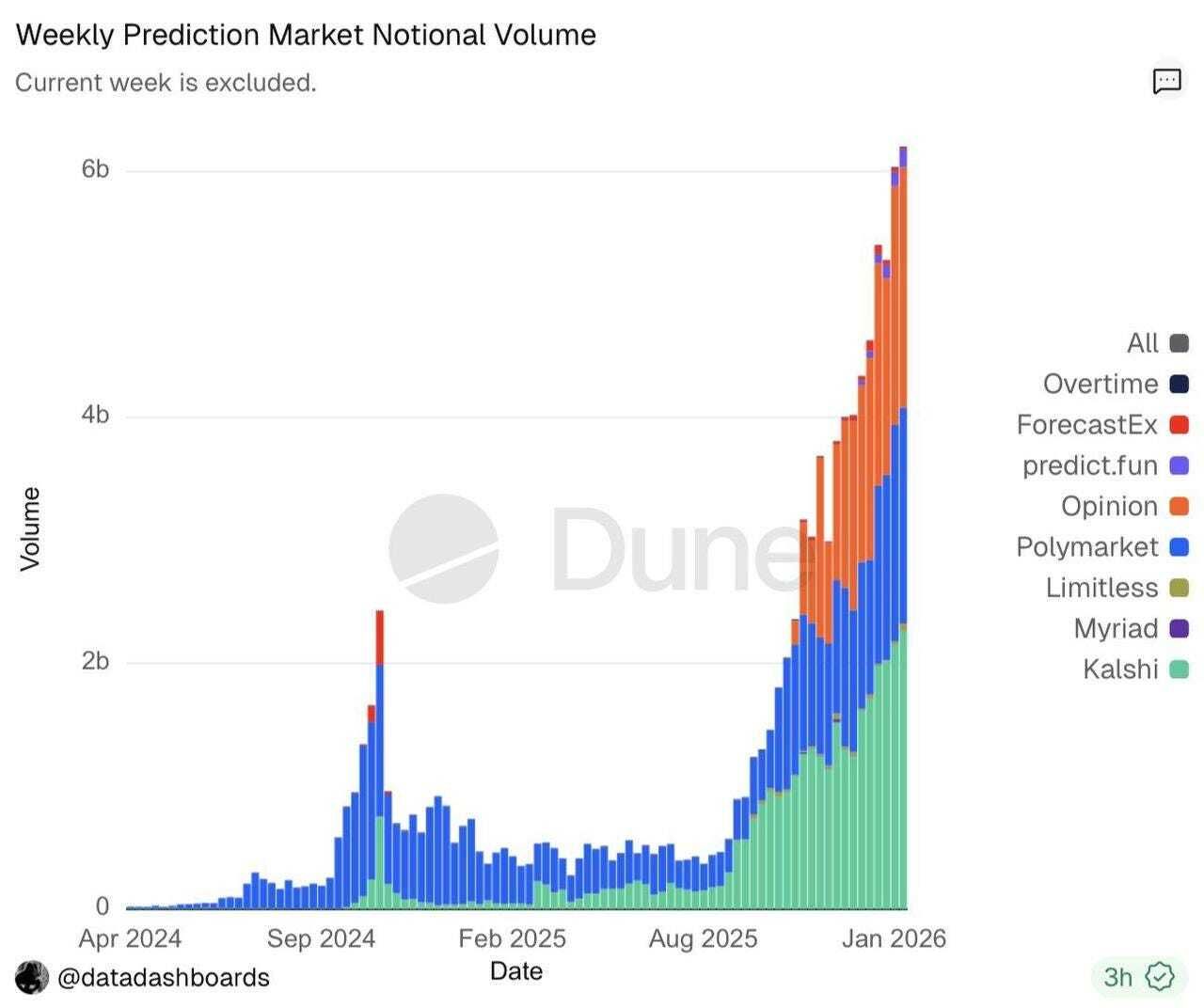

Source: Dune

Prediction markets are already an oligopoly.

Source: Rwa

Tokenized real estate sits at ~$392M across 58 properties, and it’s highly concentrated.

Source: Artemis

Robinhood is trading at ~36.7× earnings while markets are bleeding.

What Happened This Week:

Strategy bought 855 BTC for ~$75.3M at ~$87,974 per BTC

Binance SAFU Fund bought 1,315 BTC

Tom Lee’s BitMine bought 41,788 ETH worth ~$97M

Bitcoin falls to its lowest level since Trump’s election victory

What to Look Out For:

Elon Musk’s xAI starts hiring crypto experts to train AI trading models

Elon Musk says SpaceX could send a literal Dogecoin to the moon as early as next year

MetaMask partners with Ondo to offer tokenized US stocks, ETFs, and commodities

CME Group considers launching a crypto token

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.