- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

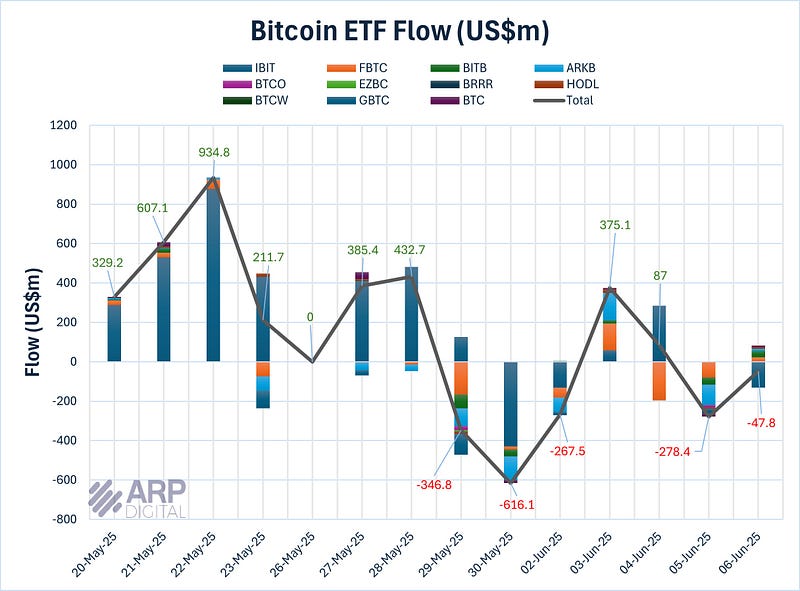

Source: Farside, ARP Digital Research Team Q3’25

Bitcoin ETFs saw $141.4 million in net outflows for the week ending 6 June 2025, as flows remained volatile following May’s abrupt reversal. The week opened with $267.5 million in outflows on Monday, followed by a sharp recovery on Tuesday with $375.1 million in inflows led by strong allocations to IBIT and ARKB.

Flows dipped again midweek, with $278.4 million in outflows on Wednesday, partially offset by $87 million in inflows on Thursday. The week closed with a $47.8 million outflow on Friday. Grayscale’s GBTC remained muted throughout, while IBIT and FBTC continued to dominate flow activity.

Macro:

Key economic indicators due next week include the May CPI/PPI in the US, as well as inflation and trade data in China. In the UK there will be the monthly GDP print for April alongside the latest labour market report.

Alphabet, Nvidia, TSMC, Alibaba and Midea go ex-div. There are also a handful of conferences relevant to Nvidia, Lilly and financials.

More Crypto:

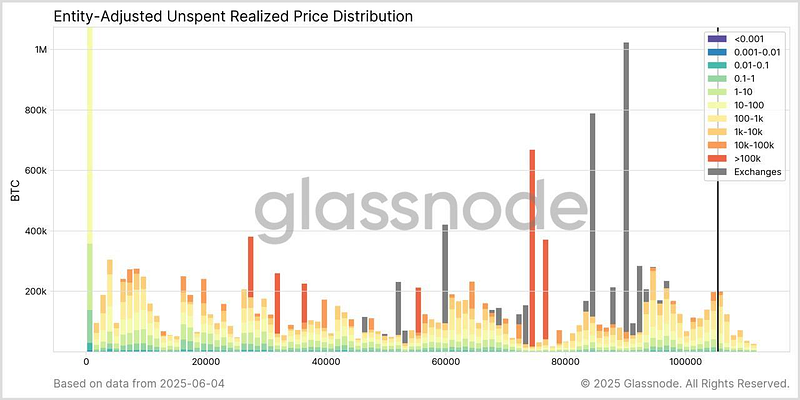

Source: Glassnode

Over the past six months, BTC market behavior has tilted toward institutions.

Above $90K, activity is dominated by wallets holding 100–10K BTC, while the biggest holders (>100K BTC) are clustered around $74K-76K, and large whales remain active between $78K and $90K.

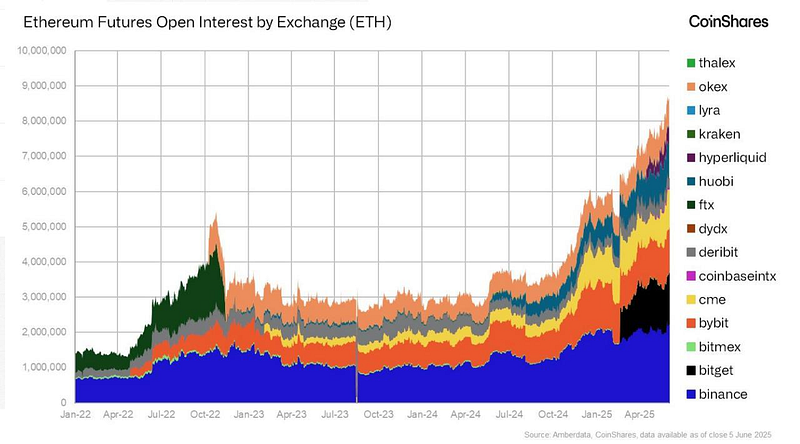

Source: Coinshares

Ethereum futures remain on the rise, with the asset holding firm after its impressive early-May rally.

The ETHBTC ratio has made a higher low, signaling that investor interest in ETH continues to build.

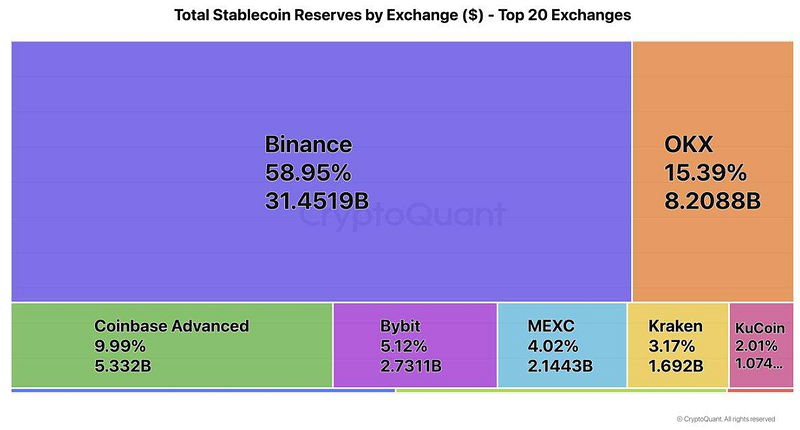

Source: CryptoQuant

Binance commands the stablecoin arena, controlling 59% of all reserves — that’s $31B in USDT and USDC alone.

In 2025, it tops the charts with $180B in net inflows and consistently attracts the largest average Bitcoin deposits.

What Happened This Week:

California law allows Bitcoin on exchanges for 3+ years to be claimed by the state.

Circle is now publicly listed on NYSE as $CRCL.

JPMorgan to accept Bitcoin & crypto ETFs as loan collateral.

US delays some China tariffs until Aug 31.

Solana Foundation partners with Dubai’s VARA to boost collaboration between crypto projects and local regulators.

What to Look Out For:

Apple, X, Airbnb, and Google are in early talks with crypto firms on stablecoin integration.

Trump says he’s unsure if his great relationship with Elon Musk will continue.

Trump’s Truth Social filed for a Bitcoin ETF.

Chinese firm Webus files to raise $300M for $XRP treasury plan.

Classover secures $500M for Solana strategy, plans to allocate up to 80% to buy $SOL.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.