- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Bitcoin’s price and ETF flows were under pressure this week as risk sentiment weakened. Bitcoin slid toward the $78,000–$80,000 area, marking fresh multi-month lows and reflecting broader market caution. Spot Bitcoin and Ethereum ETFs experienced significant net outflows, including a large single-day withdrawal from Bitcoin ETFs that alone was among the biggest in recent months, contributing to a total of roughly $1.8 billion in crypto ETF outflows over the week. This flow weakness coincided with reduced liquidity and defensive positioning from investors, keeping upward momentum capped and reinforcing the market’s risk-off tone.

Macro:

Central banks will continue to be the main theme next week with decisions due from the ECB, the BoE and the RBA. In economic data, the highlights include the US jobs report, ISM indices, and inflation in Europe. Corporate earnings include Alphabet, Amazon and AMD.

More Crypto:

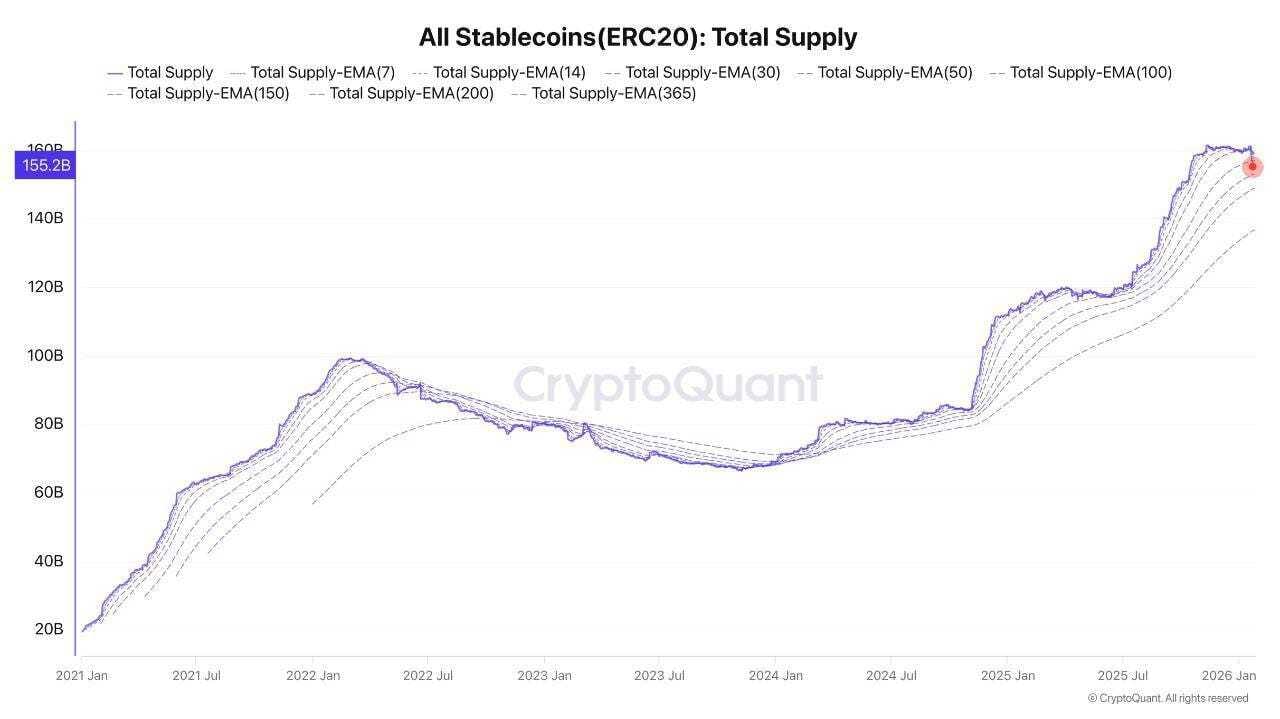

Source: CryptoQuant

We just saw the sharpest ERC-20 stablecoin drawdown of this cycle.

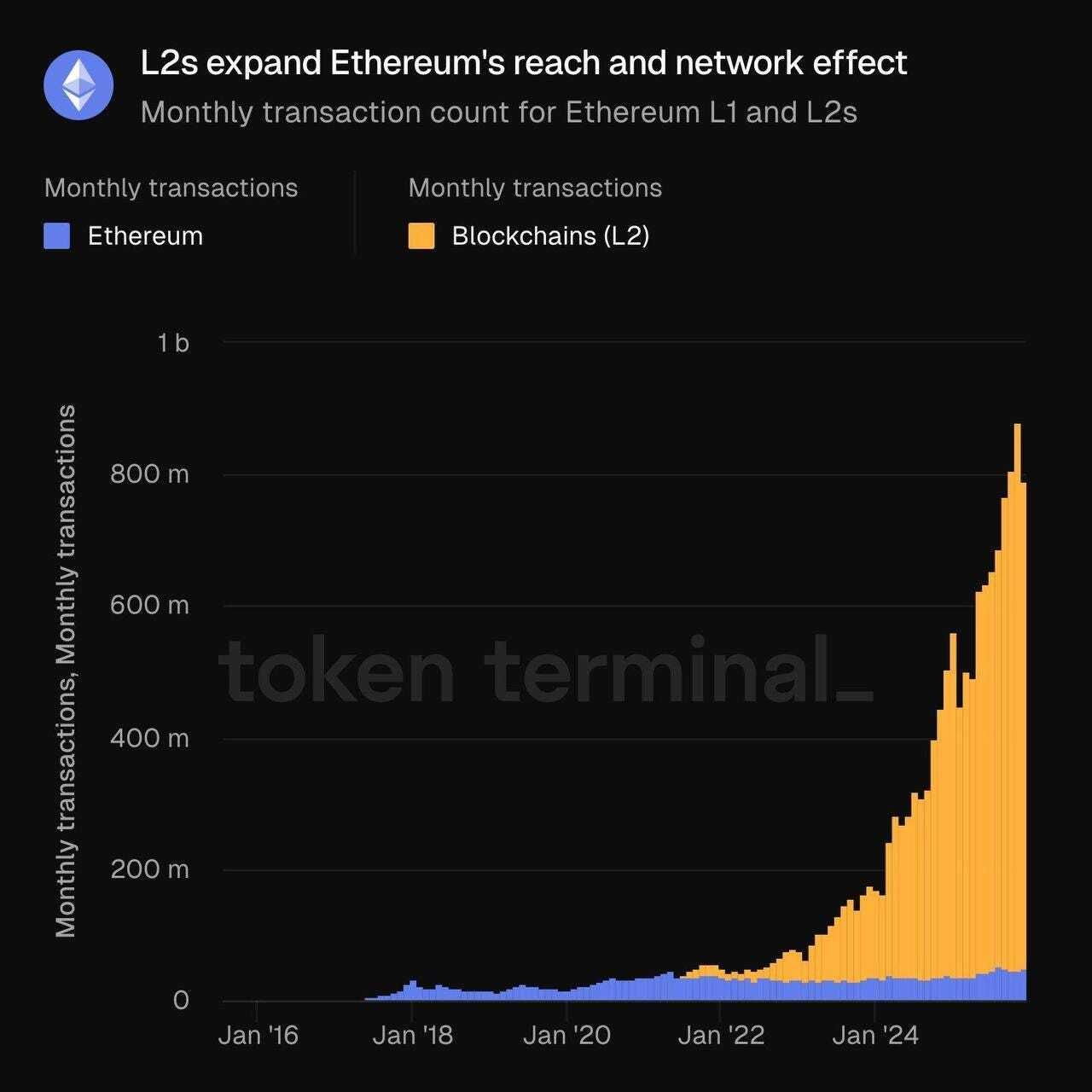

Source: Tokenterminal

L2s are doing the heavy lifting for Ethereum’s network effect.

Source: Entropy

Tether rolled out USAT to compete head-on for institutional adoption.

What Happened This Week:

Strategy buys 2,932 BTC for ~$264.1M at ~$90,061 per BTC

Tom Lee’s BitMine buys 40,302 ETH worth ~$117M

Steak ’n Shake buys $5M in BTC for its strategic Bitcoin reserve

Tether holds 140+ tons of gold worth ~$23B in a nuclear bunker

What to Look Out For:

Binance launches Tesla ($TSLA) futures trading

White House to meet banking and crypto execs Monday on stalled Senate crypto bill

Robinhood to enable 24/7 trading and self-custody via tokenized stocks

SEC and CFTC expected to sign agreement on crypto oversight

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.