- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

Source: Farside, ARP Digital Research Team Q3’25

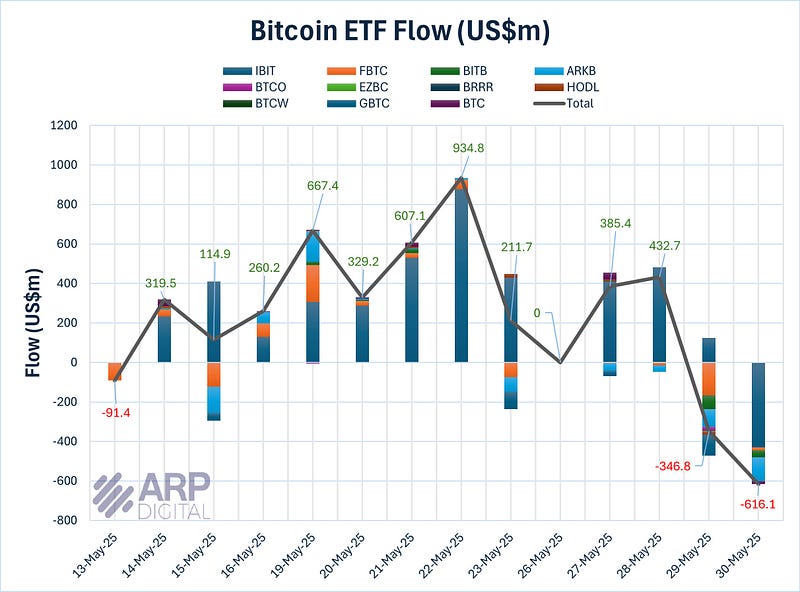

Bitcoin ETFs reversed course during the week ending May 30, 2025, recording $144.8 million in net outflows after a $3.2 billion inflow the week prior. The biggest outflow, $616.1 million on May 30, marked the fourth-worst daily loss in U.S. Bitcoin ETF history. This pullback came despite bullish news from Bitcoin 2025, including major investment plans by Trump Media, Strive, and Twenty One Capital. The contrast between strong early-week inflows and end-of-week sell-offs reflects a market split between long-term optimism and short-term profit-taking.

Macro:

Key economic indicators due next week will come from the US, including May’s jobs report and ISM indices. Elsewhere, the focus will be on ROW PMIs, inflation in Europe and wages in Japan. From a monetary policy POV, rates decisions are due from the ECB and the BoC, whilst the Federal Reserve will publish its Beige Book. We have a handful of CB speakers on the docket including Powell on Monday and Ueda on Tuesday. The Korean election will also be on held on Tuesday with Lee an overwhelming favourite.

More Crypto:

Source: Artemis, Grayscale Investment

The top cryptocurrencies in the AI sector currently include 20 tokens with a combined market cap of $21 billion, up from just $4.5 billion in Q1 2023. The largest project by market cap in the sector is Bittensor.

The largest project by market cap in the sector is Bittensor.

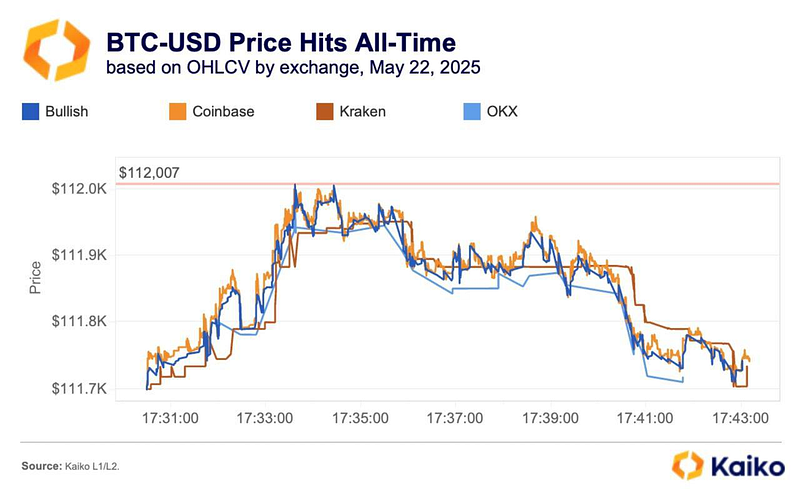

Source: Kaiko

Even with Bitcoin’s price spike, spot volumes stayed sluggish — May 22 saw just over $20B in trades, over 50% below volumes during Trump’s inauguration or the Dec 2024 rally.

Quiet funding rates and muted leverage signal retail is still largely sitting out.

What Happened This Week:

SEC drops lawsuit against Binance.

Trump slams China for breaking trade deal.

Trump Media signs $2.32B deal to hold Bitcoin as a treasury asset.

SEC says crypto staking on proof-of-stake networks isn’t a securities offering.

Meta Platforms shareholders reject Bitcoin treasury assessment proposal.

What to Look Out For:

FTX begins second $5B distribution to convenience and non-convenience classes.

SOL Strategies files to raise $1B to grow Solana investments.

Stablecoin giant Circle files for NYSE IPO

BlackRock reportedly plans to buy 10% of Circle’s IPO shares.

Trump delays 50% EU tariffs until July 9.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.