- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

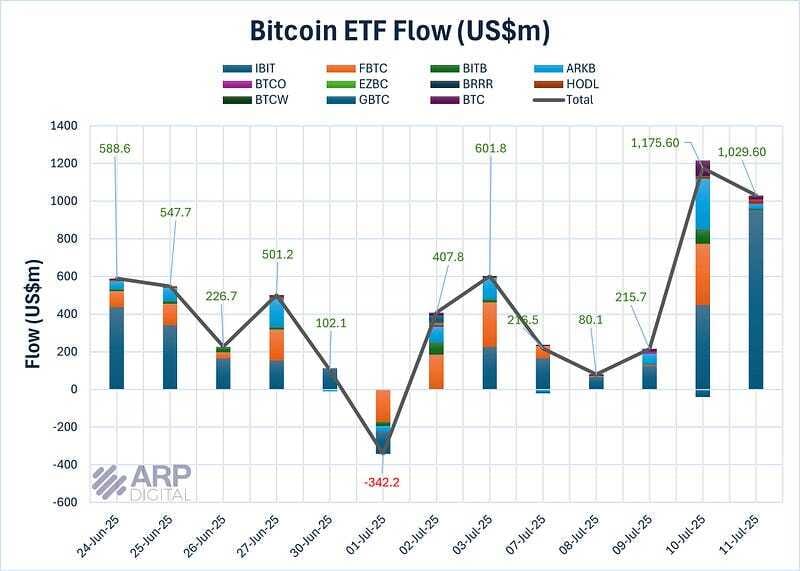

Source: Farside, ARP Digital Research Team Q3’25

A major catalyst behind this week’s price surge is the remarkable inflow into U.S. spot Bitcoin ETFs, which collectively attracted $2.7 billion in net inflows over the past seven days. Notably, two trading sessions saw inflows of over $1 billion, with July 10 alone bringing in $1.17 billion, the second-highest daily inflow in ETF Bitcoin history. Leading the charge is BlackRock’s iShares Bitcoin Trust (IBIT), which contributed $1.76 billion, bringing its total Bitcoin holdings to over 701,000 BTC, currently valued at more than $82.6 billion just 18 months after launch.

This rally has also propelled the estimated value of Satoshi Nakamoto’s Bitcoin holdings to nearly $129 billion, placing the anonymous creator among the top 11 wealthiest individuals in the world a testament to the maturing status of Bitcoin within global finance.

Macro:

The focus next week will be on inflation, with reports due in the US, Canada, the UK and Japan. In the US, there will also be retail sales and IP reports for June, along with the preliminary UMich survey for July. Growth will also be in focus in China, where Q2 GDP and June activity data is out on Tuesday. Finally, US banks kick off their Q2 earnings season on Tuesday, with semiconductor firms ASML and TSMC also reporting next week alongside a handful of names relevant to consumer staples and discretionary spending. In politics, Japan’s upper house elections will be the key event on Sunday.

More Crypto:

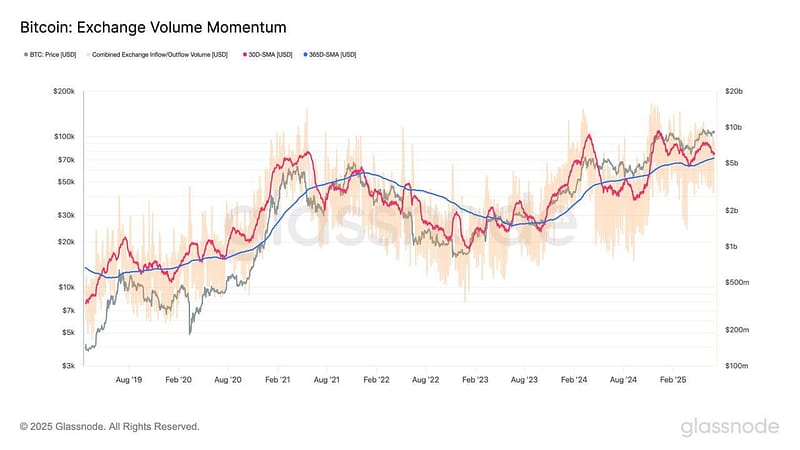

Source: Glassnode

Exchange volumes have been tapering off since early June, with the monthly average slipping to $5.9B — just 7% above the yearly norm.

It’s a subtle signal that investor enthusiasm may be cooling, even as prices hold steady.

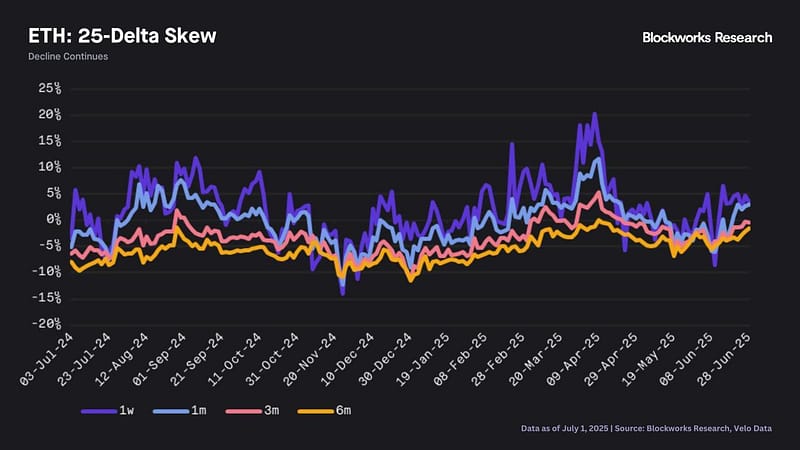

Source: Blockworks

June kept options traders on edge.

The 1-week skew swung from cautious optimism to intense downside hedging mid-month before leveling off. Meanwhile, the 6-month skew stayed negative but showed signs of easing as long-term sentiment steadied.

Source: Glassnode

A week after the largest Bybit hack, open interest on Bybit’s Ethereum perpetual contracts plummeted from $3.3 billion to $1.8 billion.

Coupled with the simultaneous drop in Ethereum’s price, open interest further declined to a cyclical low of $1.5 billion in early April, the lowest since February 2024. However, since hitting that low, the market has shown a steady recovery, with open interest jumping to $3.9 billion, well above pre-hack levels.

What Happened This Week:

Tesla holds over $756M in unrealized profit from its Bitcoin investment.

U.S. Treasury drops crypto broker reporting rules.

Michael Saylor’s Bitcoin bet now holds $24B in unrealized profit.

Robinhood now officially offers ETH and SOL staking in the U.S.

Bit Digital shifts entire treasury into ETH, now a top public holder after $173M buy.

What to Look Out For:

Trump’s Truth Social teases a utility token linked to user engagement and streaming.

Ripple to deposit $500M $RLUSD stablecoin reserve with BNY Mellon.

Trump’s Truth Social files S-1 for a crypto ETF featuring BTC, SOL, XRP, and CRO.

Tether built a Swiss gold vault holding $8B to cut custody costs and grow reserves.

Lutnick says tariffs start August 1.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.