- Arp Digital

- Posts

- ARP's Crypto Digest

ARP's Crypto Digest

General Digital Asset Market View:

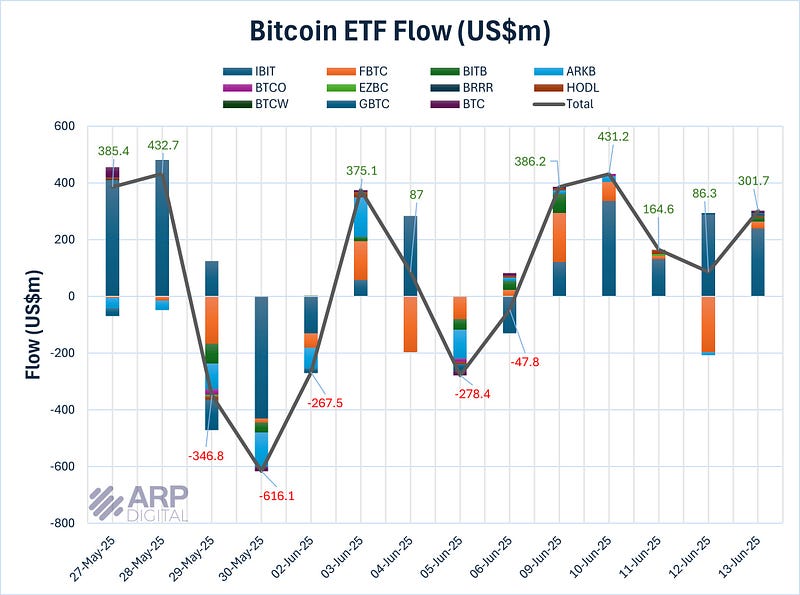

Source: Farside, ARP Digital Research Team Q3’25

Regarding the Bitcoin Spot ETFs, performance was strongly positive over the week. On June 9, BlackRock alone purchased $120.1M worth of Bitcoin, contributing significantly to the day’s total net inflow of $386.2M. This buying momentum continued on June 10, with BlackRock acquiring another $336.7M, aligning with the day’s overall inflow of $431.2M. The trend persisted through the following days, with steady institutional demand supporting inflows of $162.3M on June 11, $100.8M on June 12, and $301.7M on June 13. This marked five consecutive days of inflows, underscoring strong and sustained institutional interest in Bitcoin, with BlackRock clearly emerging as the dominant driver behind the ETF flows.

Macro:

Events in our backyard will be the most important focus over the coming days, with investors focused on the potential for further escalation between Israel and Iran. Otherwise, monetary policy will be a key theme, with decisions due from the Fed, the BoJ, the BoE and SNB among others. From a high frequency data PoV, the focus will be on May economic activity indicators in the US (retail sales & IP) and China (monthly data dump). Elsewhere, the UK and Japan will release CPI reports. Rounding out key events, in geopolitics, the highlight is the G7 Summit on June 15–17.

More Crypto:

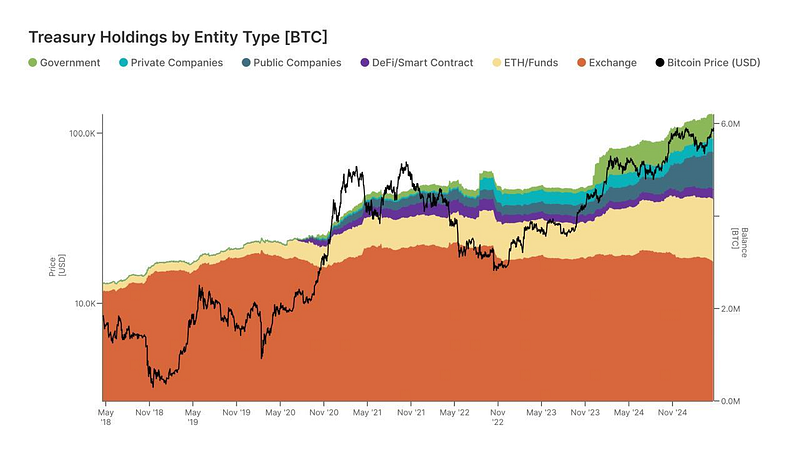

Source: Glassnode

About 30% of all bitcoins are controlled by 216 centralized organizations, including governments and public companies.

This dynamic may indicate the growing interest and influence of institutional investors and the market’s transition to a more centralized model of asset storage.

Source: Coinshares

In 2020, we saw reversals similar to those that are happening on the market now.

But this time the previous waves were neither big nor small, so they are a little difficult to interpret. It doesn’t look like a full-fledged bull market, but it doesn’t look like a mini-bull market of 2019.

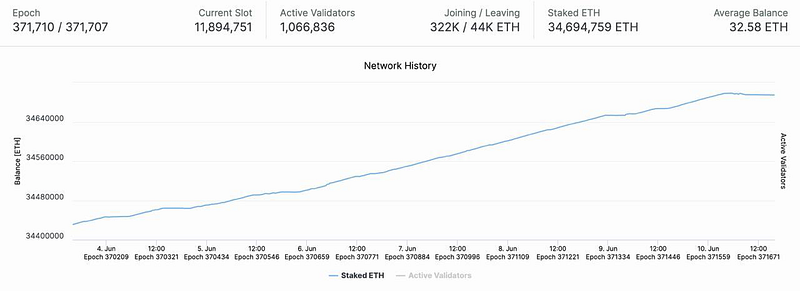

Source: Beaconcha

ETH staking has reached a new ATH.

Ethereum keeps setting records as network confidence grows.

What Happened This Week:

SEC approves Trump Media’s Bitcoin Treasury registration.

DeFi Development Corp. (Nasdaq: $DFDV) secures $5B equity line to fuel $SOL accumulation and SPS growth.

US PPI rises to 2.6%, below expectations; Core PPI at 3.0% vs. 3.1% expected.

Japanese fashion firm ANAP Holdings boosts Bitcoin holdings by 50.56 BTC in two days, now totaling 153.46 BTC.

US inflation rises to 2.4%, under the 2.5% forecast.

What to Look Out For:

Saylor hints at more Bitcoin buying.

Bitwise, Canary, and Grayscale include staking in Solana ETF filings.

Vietnam legalizes digital assets under new law starting Jan 1, 2026.

Walmart and Amazon exploring stablecoin issuance.

Bloomberg reports the SEC may approve spot Solana ETFs within a month amid Rex Shares and Osprey’s regulatory push.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.