- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

U.S. spot Bitcoin ETFs added $1.63 billion last week, bringing four-week net intake to $3.96 billion and marking nine positive weeks out of the last twelve.

The 12-week rolling sum stands at $6.08 billion, roughly mid-range for 2025 based on CryptoSlate’s internal tracker built from fund disclosures and public flow tables.

Year to date, net inflows total $22.78 billion, with $58.44 billion since inception.

An assets-under-management proxy is $155.9 billion, while the average weekly value traded over the past four weeks is $16.17 billion compared with a 12-week average of $17.90 billion.

Macro:

U.S. markets advanced despite the government shutdown halting key data releases. Investors relied on private payroll data showing job losses, which boosted expectations of imminent Fed rate cuts. Treasury yields fell as bond prices rose, while tech and small-cap stocks outperformed on hopes of easier monetary policy. Overall, softer labor and confidence figures pointed to a cooling economy but reinforced optimism for a gentler path ahead with potential rate relief.

More Crypto:

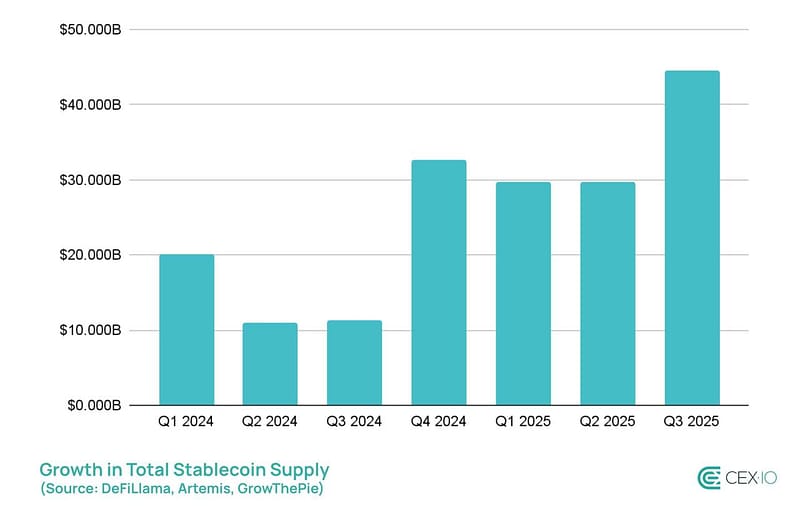

Source: Cex.io

Stablecoin transfer volume hit an ATH of $15.6 trillion in Q3 2025 — and 71% of it came from trading bots.

Algorithms are taking over the flow.

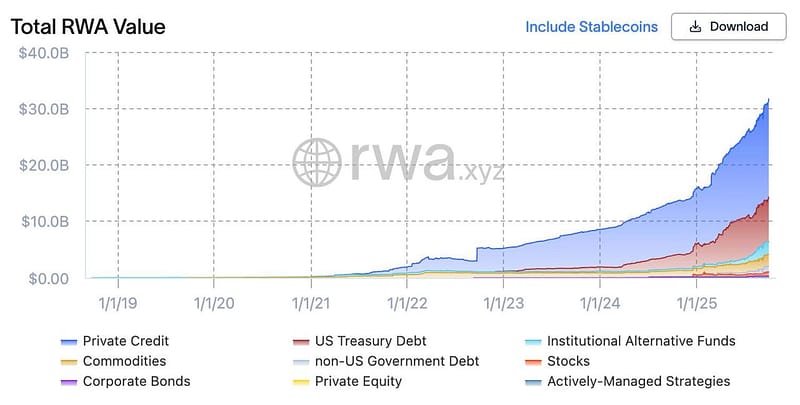

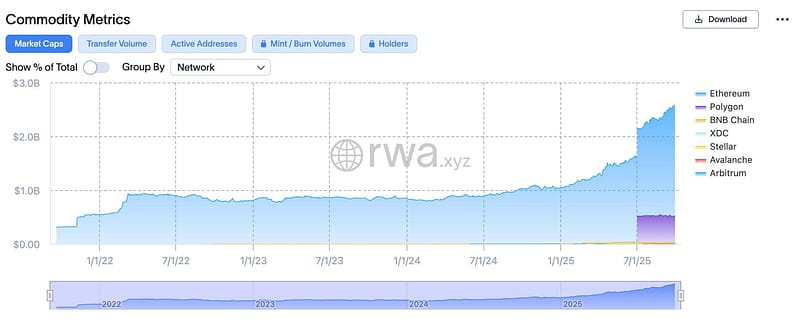

Source: RWAxyz

Total on-chain RWA value rose 5.6% over the past 30 days, now topping $30 billion.

Over $2.5 billion worth of tokenized gold is now circulating on Ethereum — more than double since the start of the year.

Source: RWAxyz

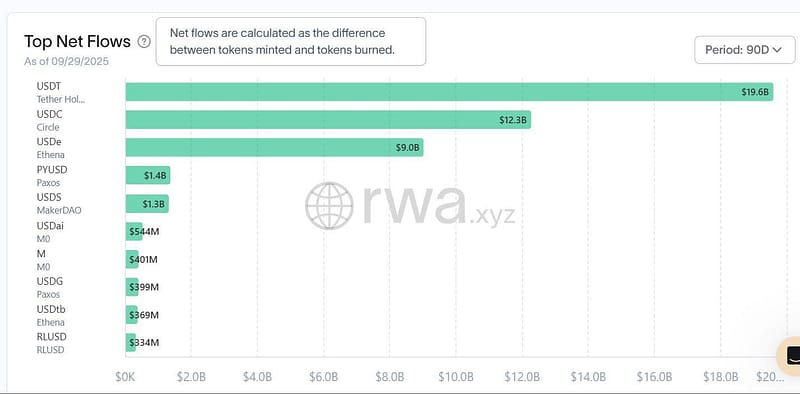

Stablecoin inflows reached $56.5B over the past six months, with only $10.8B arriving in Q2.

The surge came in Q3, driven not just by USDT and USDC but also by rising demand for algorithmic options like USDe.

What Happened This Week:

VanEck files for a Lido Staked Ethereum ETF in Delaware.

Coinbase partners with Samsung to bring crypto access to its wallet app.

US government shutdown halts ETF approvals.

The SEC granted a no-action letter allowing advisers to use state trust companies as crypto custodians.

Strategy bought 196 BTC for ~$22.1M at ~$113K each.

What to Look Out For:

Solana ETF issuers prepare for possible SEC approval this week.

Worldlibertyfi will launch a crypto debit card with Apple Pay by year-end.

SEC Chair Paul Atkins calls crypto his top priority.

Vanguard explores offering crypto ETF access to brokerage clients.

SWIFT is developing stablecoin and onchain messaging solutions on Linea.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.