- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Source: Farside, ARP Digital Research Team Q3’25

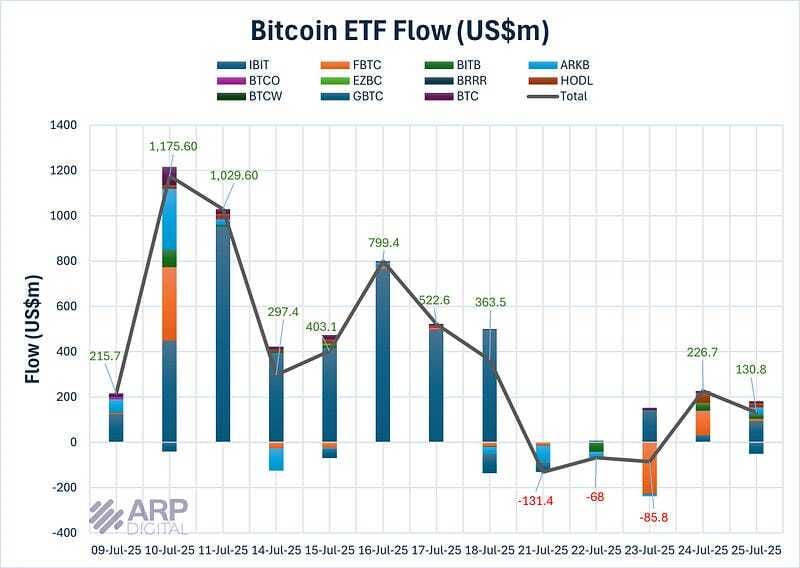

U.S. Bitcoin spot ETFs saw their weakest inflow since mid-April, attracting only $72.3 million for the week, far below the $2.7B and $2.38B of the previous two weeks. BlackRock’s IBIT remained the only ETF showing strong demand, bringing in $267.9 million, while most other funds were net sellers between July 21 and 23. The sharp drop in inflows suggests profit-taking behavior among institutional investors following BTC’s recent all-time high near $123,000.

Trade negotiations with the US will continue to be the key theme ahead of the August 1st deadline. Before that, attention will fall on US-China talks in Stockholm early next week as well as any takeaways from the Korean delegation visit to the US. The focus will also be on rate decisions from the Fed, the BoC and the BoJ. In economic data, highlights include US Q2 GDP and the jobs report in the US, Q2 GDP and inflation in Europe as well as PMIs in China. In corporate earnings, four of the Mag7 report.

More Crypto:

Source: SoSo Value

Ethereum spot ETFs are seeing unprecedented demand — July alone has brought in $4.1B in net inflows.

That’s already double the previous monthly record set in December 2024, and the month isn’t over yet. Institutions are showing up for ETH in force.

Source: Glassnode

Bitcoin’s dominance slipped from 63.76% to 60.78% in just one week — a sharp 2.98 percentage point drop.

One of the steepest declines this year, as capital continues to rotate into altcoins.

Source: Stablewatch

Stablecoins are leading the charge into this cycle.

Yield-bearing stablecoins are surging, turning idle capital into income. Their mcap jumped 45% in H1 2025, reaching $12.4B.

What Happened This Week:

SEC halts approval of Bitwise’s broad crypto ETF.

Jack Dorsey’s Square starts onboarding merchants for new Bitcoin payment feature.

21Shares files with SEC to launch an ONDO ETF.

Sharplink bought 79,949 ETH between Jul 14–20 at $3,238 avg, totaling $258M.

FBI ends probe into Kraken founder.

SEC Chair Paul Atkins says $ETH “is not a security.

What to Look Out For:

US to release crypto report on July 30.

Joe McCann plans $1B raise for Solana Treasury Co after ~70% liquid fund drawdown.

Polymarket considers launching its own stablecoin.

SpaceX moves Bitcoin for the first time in 3 years.

Polymarket acquires exchange to re-enter US after DOJ probe ends.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.