- Arp Digital

- Posts

- Arp's Crypto Digest

Arp's Crypto Digest

General Digital Asset Market View:

Institutional inflows continue to drive Bitcoin’s price momentum. On October 24, U.S. spot Bitcoin ETFs saw $446.6M in net inflows, led by BlackRock’s IBIT ($324.3M) and Fidelity’s FBTC ($52.3M), underscoring rising institutional confidence. The rebound from the $1.23B outflows in mid-October suggests investors view dips as buying opportunities.

Markets now await the Fed’s October 29 decision, a dovish tone or December rate-cut signal could lift Bitcoin, while a hawkish stance may pressure risk assets. The potential Trump-Xi meeting also adds uncertainty to the near-term outlook.

Macro:

The focus will be on policy decisions from the Fed, the BoC, the ECB and the BoJ. Economic indicators due include GDP in the US (TBC), Europe, Korea and Taiwan, inflation in Europe and Tokyo and PMIs in China. The spotlight is also on US President Trump’s trip to Asia as well as earnings from Microsoft, Alphabet, Meta, Apple and Amazon, representing a quarter of the S&P 500’s market cap.

More Crypto:

Source: Token Terminal

Out of the top 10 chains by active users (fee-paying addresses), four are still costly to use — Ethereum, Bitcoin, Tron, and BSC.

High fees clearly haven’t stopped them from dominating in daily usage.

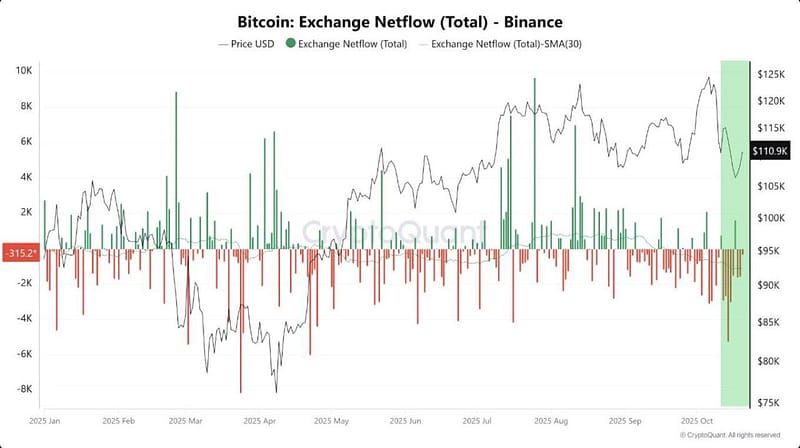

Source: CryptoQuant

Daily BTC flows on Binance may fluctuate, but the 30-day moving average reveals a clear trend: more Bitcoin is consistently leaving exchanges.

This typically signals an accumulation phase, with investors choosing to hold rather than sell.

What Happened This Week:

US September CPI and core CPI both rose 3% year-over-year, slightly below expectations.

Trump appoints Michael Selig as new CFTC chair.

Trump pardons Binance founder CZ after his conviction.

Hong Kong approves its first spot Solana ($SOL) ETF.

FalconX to acquire 21Shares.

What to Look Out For:

Tether plans USAT stablecoin launch in December, targeting 100M Americans.

JPMorgan to Allow Bitcoin, Ether as Collateral in Crypto Push.

Trump to hold bilateral meeting with Xi next Thursday morning.

JPMorgan expects the Fed to end QT next week.

The Fed is exploring “payment accounts” to give crypto and fintech firms access to its payment rails.

What we enjoyed reading and listening to:

ARP Digital is regulated by the Central Bank of Bahrain as a Category 3 Crypto Asset Service Provider. All communications and services are directed at Professional Clients only, persons other than Professional Clients, such as Retail Clients, are NOT the intended recipients of our communications or services. ARP Digital does not provide investment advice, and nothing herein shall be considered, construed as, or deemed to be, investment advice. Furthermore, nothing herein is intended to be, or shall constitute, an offer or invitation to buy securities or any form of financial instrument or investment product by ARP Digital or any of its related parties or persons.